Table of Contents >> Show >> Hide

- Corrections vs. Bear Markets: The Labels That Make Investors Sweat

- Why the 60/40 Portfolio Exists (And Why It Still Shows Up to the Party)

- What History Suggests: Drawdowns Are Usually Smaller, Recoveries Can Take Longer

- The Simple Math of Getting Back to Even

- The Bond “Ballast” Relationshipand When It Breaks

- What to Do During a Correction or Bear Market (Without Becoming Your Own Worst Enemy)

- Recoveries: The Part Everyone Wants, But Nobody Wants to Wait For

- How to Stress-Test a 60/40 Portfolio (Before the Next Storm Hits)

- Common Myths About the 60/40 Portfolio

- Bottom Line: A 60/40 Portfolio Is a Trade-Off Machine

- Experiences From the Real World: What 60/40 Corrections and Recoveries Feel Like

- Conclusion

If investing had a “classic outfit,” it would be the 60/40 portfolio: 60% stocks for growth, 40% bonds for stability.

It’s the financial equivalent of wearing sneakers with your nice clothespractical, not flashy, and usually a good idea.

But what happens when markets get messy? Corrections, bear markets, ugly headlines, and that one friend who suddenly becomes a macroeconomist.

This guide breaks down how a traditional 60/40 portfolio has behaved during market corrections and bear markets, what “recovery” actually means,

and why balanced investing often feels like you’re doing the right thing… at a slightly slower speed than your neighbor’s all-stock portfolio.

Corrections vs. Bear Markets: The Labels That Make Investors Sweat

What counts as a market correction?

In everyday investing language, a market correction usually means a major stock index drops more than 10% but less than 20%

from a recent peak. The idea is that prices “correct” back toward a longer-term trend.

What counts as a bear market?

A bear market is typically a decline of 20% or more from a recent high. That’s the level where the mood shifts from

“this is fine” to “should I learn how to grow potatoes?”

Can a correction turn into a bear market?

Sometimes. But not always. One of the cruel jokes of investing is you don’t know what you’re in until you’re already in it. That’s why a balanced approach

matters: it’s built for uncertainty, not perfect prediction.

Why the 60/40 Portfolio Exists (And Why It Still Shows Up to the Party)

The core promise of 60/40 is simple: stocks drive long-term growth, while bonds help dampen volatility and cushion drawdowns.

Bonds often act like the shock absorbers on a bumpy road. You still feel the potholesyou just don’t lose your teeth.

The point isn’t to “beat stocks” in a roaring bull market. The point is to create a portfolio that:

- Hurts less when markets drop

- Stays investable when emotions get loud

- Supports real-life needs (like withdrawals, rebalancing, and sleeping at night)

What History Suggests: Drawdowns Are Usually Smaller, Recoveries Can Take Longer

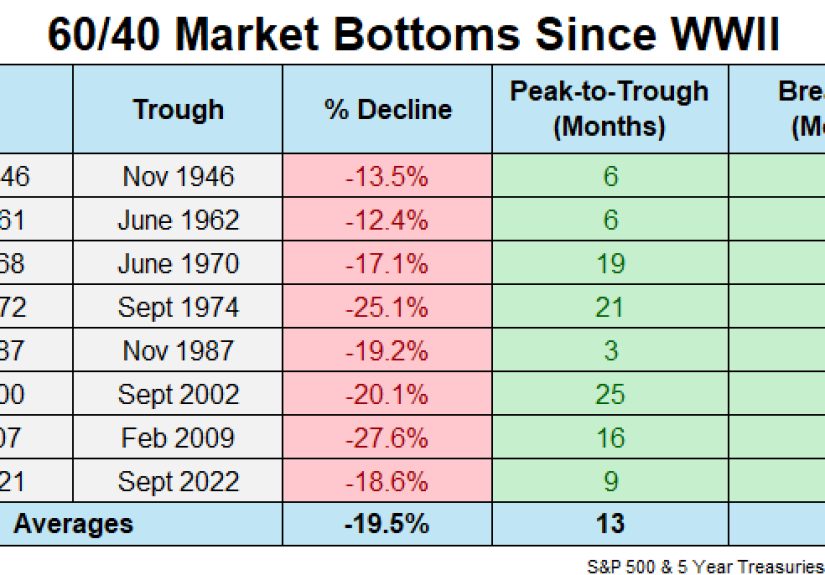

Looking at post–World War II data using a simple mix of U.S. stocks and intermediate Treasuries, the story is surprisingly consistent:

a 60/40 portfolio tends to have fewer and shallower big declines than stocks alone.

Fewer double-digit drawdowns than the stock market

Since 1945, a classic 60/40 portfolio experienced far fewer double-digit drawdowns than the stock market.

Stocks can rack up double-digit drops like they’re collecting stamps. A balanced portfolio, by design, collects fewer.

But recovery can be slower (yes, even after a smaller loss)

Here’s the trade-off that surprises people: even though the losses are usually more muted, the recovery back to breakeven can take longer.

Why? Because bonds typically deliver lower long-term returns than stocks, and balanced portfolios have less “rocket fuel” in the rebound phase.

In fact, historical analysis of post-1945 60/40 drawdowns shows an average breakeven time measured in years, not weeks.

That’s not a flawit’s the cost of stability.

The Simple Math of Getting Back to Even

Recoveries feel confusing because the math is not emotionally intuitive. A portfolio that drops 20% doesn’t need a 20% gain to recoverit needs 25%.

Here’s a quick snapshot:

- -10% needs about +11.1% to break even

- -20% needs +25%

- -30% needs about +42.9%

A 60/40 portfolio usually falls less than an all-stock portfolio in a bear market. Great. But the “40” partbondstends to climb like a treadmill walk,

while stocks can bounce like a trampoline. If you own fewer trampolines, you’ll still get there… just with fewer backflips.

The Bond “Ballast” Relationshipand When It Breaks

Why bonds often help during stock sell-offs

In many stock downturns, high-quality bonds (like Treasuries) have historically held up better or even risen, helping offset stock losses.

When stocks fall and investors seek safety, bond prices can riseespecially when interest rates are falling.

2022: The year the shock absorbers hit a pothole

The modern poster child for “stocks and bonds can fall together” is 2022, when inflation and rapid interest-rate hikes pressured both asset classes.

That year sparked endless “Is 60/40 dead?” hot takes, usually delivered with the energy of a guy yelling at clouds.

The more useful lesson isn’t “60/40 failed.” It’s: correlations can change. When inflation is high and rates rise sharply, bond prices can fall,

and the traditional diversification benefit may weaken temporarily. Balanced portfolios can have rough stretchesjust fewer of the catastrophic ones.

What to Do During a Correction or Bear Market (Without Becoming Your Own Worst Enemy)

1) Rebalancecarefully and consistently

Rebalancing means bringing your portfolio back to its target mix. If stocks fall, your 60/40 might drift to 55/45. Rebalancing nudges you back toward 60/40,

which often means buying what’s down and trimming what’s upthe opposite of panic behavior.

There are multiple practical ways to rebalance:

- Use new contributions to buy whichever side is underweight

- Shift dividends and interest toward the underweight asset

- Sell a portion of the overweight side (with taxes and costs in mind)

Many investors use a simple “tolerance band” rule (for example, rebalance when an allocation drifts too far from target) instead of obsessing weekly.

The goal is discipline, not perfection.

2) Match the portfolio to your timeline, not your mood

Balanced portfolios exist for a reason: real humans have real goals. If you’re investing for something soontuition, a home down payment, retirement income

then volatility matters. Your time horizon and risk tolerance should drive your mix, not today’s headline.

3) If you’re withdrawing money, use the “sell what held up” idea

One overlooked benefit of 60/40 is flexibility during drawdowns. If stocks are down and bonds held up better, you may be able to take withdrawals from bonds

instead of selling stocks at depressed prices. That can reduce the damage that withdrawals can do during bad markets.

Recoveries: The Part Everyone Wants, But Nobody Wants to Wait For

A bear market can feel endless while you’re living through it, but historically they tend to be shorter than bull markets. Over long market history,

bear markets have averaged months, not decades, though the range can be wide.

The “best days” problem

One of the most annoying facts in investing is that some of the market’s strongest days often happen during the worst stretcheseither in bear markets

or right after them. If you sell out after the decline, you risk missing the rebound. And missing rebounds can be expensive.

The balanced-portfolio version of this lesson is simple: staying invested is part of the strategy. The 60/40 approach is built to make

staying invested psychologically easierless gut punch, more persistence.

How to Stress-Test a 60/40 Portfolio (Before the Next Storm Hits)

Check the “sleep test”

If your portfolio drops and you can’t sleep, that’s data. Not “the market is rigged” datayour risk level might be too high data.

A portfolio only works if you can stick with it.

Know what kind of 40 you own

“Bonds” is not one thing. Short-term Treasuries behave differently than long-term bonds. Investment-grade bonds behave differently than junk bonds.

The type of bond exposure you hold can change how much ballast you actually get when stocks fall.

Decide your rules when you’re calm

If you wait until markets are down 18% to decide what you “believe,” you’re making rules in a hurricane. Better:

- Set a rebalancing schedule (quarterly, semiannual, or annually)

- Set drift bands (for example, rebalance if you drift more than X%)

- Write down what would actually cause you to change risk (job loss, big life event, timeline shift)

Common Myths About the 60/40 Portfolio

Myth: “60/40 is dead.”

The 60/40 portfolio isn’t a magical creature that lives forever without drawdowns. It’s a framework.

Sometimes it looks brilliant. Sometimes it looks boring. And in rare years, it looks like it got caught in the rain without an umbrella.

But “dead” is usually just a dramatic way of saying, “It didn’t work perfectly in a very specific environment.”

Myth: “Bonds always protect you.”

Bonds can help, but they are not invincible. When rates rise quickly, bond prices can fall. The key is understanding what role bonds play:

stability, income, liquidity, and diversificationmost of the time, not all of the time.

Myth: “Rebalancing guarantees higher returns.”

Rebalancing is mostly a risk management tool. It helps maintain your intended level of risk and can encourage buy-low/sell-high behavior.

But it’s not a cheat code. It’s a seatbelt.

Bottom Line: A 60/40 Portfolio Is a Trade-Off Machine

The 60/40 portfolio is not designed to win every year. It’s designed to create a smoother ride so more investors can actually stay on the road.

Historically, balanced portfolios have tended to:

- Have shallower drawdowns than stocks alone

- Still experience corrections and bear-market pain

- Often take longer to recover than stocks after major declines

- Provide useful flexibility for rebalancing and withdrawals

If you want a portfolio that lets you participate in growth without relying on perfect nerves, 60/40 remains a solid starting point.

Not perfect. Just practical. Like owning a fire extinguisheryou hope you never need it, but you’re glad it’s there.

Experiences From the Real World: What 60/40 Corrections and Recoveries Feel Like

Investors don’t experience markets in neat charts. They experience them in late-night doomscrolling, awkward dinner conversations, and the sudden urge

to “just check the account one more time.” A 60/40 portfolio is often described with tidy words like balanced and diversified,

but the lived experience is more like: “I’m still uncomfortable, just less dramatically uncomfortable.”

One common experience shows up in classic equity bear markets like 2008. Stocks fall hard, news turns bleak, and the all-stock crowd feels like they’re

riding a roller coaster with the safety bar unlatched. The 60/40 investor still feels the drop, but the bond sleeve often acts like a handrail.

Psychologically, that matters. A smaller drawdown can be the difference between “I’m sticking to the plan” and “I just sold everything and now I’m

researching bunkers.”

Then comes the recovery phase, and this is where balanced investing can mess with your head. When stocks rebound sharply, the 60/40 portfolio may recover

more slowly because a meaningful chunk is in bonds, which typically don’t surge. This can create a weird emotional whiplash: you were grateful for bonds

on the way down, then slightly annoyed at them on the way up. The experience teaches a key lesson: diversification is rarely loved in the moment.

It’s loved in hindsightafter it helped you avoid the decisions you’d regret.

The 2020 crash offers another familiar experience: speed. Markets can drop fast and recover faster than your emotions can process.

Balanced investors often report that their biggest challenge wasn’t the declineit was resisting the urge to “wait for clarity.”

Waiting for clarity usually means buying back in after prices rise, because clarity tends to arrive once the rebound is already underway.

This is one reason many 60/40 investors lean on automatic contributions and simple rebalancing rules: it reduces decision points when decisions are hardest.

And then there’s 2022, the year that taught investors a humbling truth: stocks and bonds can fall together.

The experience of a 60/40 drawdown during a rising-rate inflation shock felt different. People who expected bonds to always zig when stocks zag

had to update their assumptions. In many households, it sparked practical changes: shifting some bond exposure shorter, adding cash reserves for near-term spending,

or revisiting whether the “40” should include more than one type of fixed income. The healthiest investor reaction wasn’t panicit was education and adjustment.

Finally, one of the most powerful real-world experiences is what retirees and near-retirees learn during bear markets: the value of having a “spender-friendly”

portfolio. When your paycheck stops, your portfolio becomes the paycheck. A 60/40 structure can help by offering a pool of assets (often bonds) to draw from

when stocks are down, reducing the odds that you lock in equity losses at the worst possible time. Investors who’ve lived through multiple cycles often say the same

thing in different words: the best portfolio isn’t the one with the highest hypothetical returnit’s the one you can stick with through bad seasons.

Conclusion

Corrections and bear markets aren’t design flaws in the marketthey’re recurring features. The 60/40 portfolio doesn’t eliminate those storms,

but it has historically helped many investors avoid the “sell low, buy high” trap by reducing the emotional intensity of drawdowns.

The trade-off is that recoveries can take patience, because balanced portfolios don’t rebound as explosively as all-stock allocations.

If there’s one practical takeaway, it’s this: set your allocation based on your goals and timeline, rebalance with discipline, and treat scary headlines like

weather reportsuseful to know, but not a reason to rebuild your house every time it rains.