Table of Contents >> Show >> Hide

- What Gartner Actually Forecast: 11.3% Growth to $880 Billion

- Why Software Kept Growing in a “Downturn”

- Where the $880 Billion Was Going

- What Actually Happened After 2023

- Implications for SaaS Founders and Revenue Leaders

- 500-Word Experience Deep Dive: Living Through the 11.3% Forecast

- Conclusion: The Real Meaning of $880 Billion

In 2022–2023, if you only looked at tech headlines, you’d think the sky was falling:

layoffs, slumping SaaS multiples, VC “winter,” and endless talk of a downturn.

Yet in the middle of all that doomscrolling, Gartner quietly dropped a very different

signal: business software spending was still expected to grow 11.3% in 2023,

reaching about $880 billion worldwide. That’s not a slowdown. That’s a rocket ride.

SaaStr picked up this forecast and asked the obvious question: if software budgets

are still rising, why does it feel so hard to sell right now? The answer is that

we’re not in a simple “up or down” cycle. We’re in a reallocation cycle. Companies

are cutting anything that looks like a “nice to have” and doubling down on software

that directly boosts revenue, efficiency, or resilience.

In this article, we’ll unpack what Gartner’s 11.3% forecast really meant, how it fit

into the broader IT spending picture, and what actually happened after 2023. Then

we’ll dig into practical lessons for SaaS founders, sales and marketing leaders, and

buyers trying to navigate software decisions in a world where spending risesbut

scrutiny rises even faster.

What Gartner Actually Forecast: 11.3% Growth to $880 Billion

Gartner’s October 2022 outlook painted a surprisingly bullish picture for business

software. While hardware and devices were under pressure from inflation, supply chain

issues, and weaker consumer demand, enterprise software was the star of the IT

budget. The firm projected that organizations would spend roughly

$880 billion on business software in 2023, up 11.3% from 2022.

That “business software” bucket covers the tools most of us rely on every day:

customer relationship management (CRM), enterprise resource planning (ERP),

human capital management (HCM), collaboration and productivity suites, security

and infrastructure software, and a massive, fast-growing universe of cloud and

SaaS products layered on top.

In other words, while some budgets were being squeezed, software remained

the primary engine of digital transformation. Companies still needed to:

- Automate manual processes and reduce labor costs.

- Improve sales efficiency and customer retention.

- Secure distributed workforces and cloud environments.

- Modernize legacy systems that were costly to maintain.

So even as CFOs asked tough questions, they weren’t shutting down software

investmentsthey were reshaping them.

Where Software Fits in the Overall IT Spending Picture

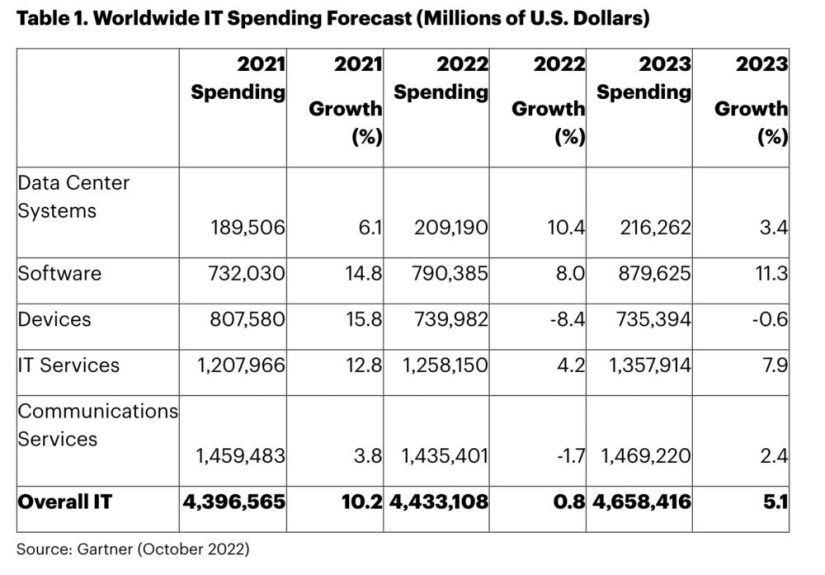

To understand why an 11.3% bump in software spending is such a big deal, you have

to zoom out. Across multiple 2022–2023 forecasts, Gartner projected

total worldwide IT spending in the ballpark of $4.5–$4.7 trillion in 2023:

- Devices: under pressure as consumers delayed upgrades.

- Data center systems: growing modestly, with some digestion after big cloud infrastructure build-outs.

- IT services and consulting: solid growth as companies leaned on outside expertise.

- Enterprise software: the fastest-growing major category.

The key point: software was gaining share inside the IT budget.

Even when overall IT spend growth slowed to low single digits in some forecasts,

enterprise software kept growing at a double-digit rate. Think of it as the

compounding core of digital business strategy.

Why Software Kept Growing in a “Downturn”

On paper, the macro environment in 2022–2023 was rough: inflation, rising interest

rates, geopolitical uncertainty, and tech sector corrections. So why did business

software keep marching upward?

1. Digital Is No Longer Optional

For most industries, “going digital” is no longer a projectit’s the operating system

of the business. Retailers need omnichannel commerce. Manufacturers rely on connected

supply chains. Financial firms live and die on risk modeling and compliance software.

Health systems depend on electronic health records and telehealth platforms.

That makes a huge chunk of software spending non-discretionary. You

can delay a laptop refresh. You cannot simply shut down your CRM or your ERP without

effectively turning off the lights.

2. Subscription Models Keep Spending Sticky

The rise of SaaS and subscription-based licensing has made software spending more

predictableand stickier. Once you’re locked into a mission-critical SaaS tool,

unwinding it is painful: data migrations, process changes, retraining, contract

penalties, and potential downtime.

In tight times, most companies don’t rip out core systems. Instead, they:

- Trim unused seats and add usage controls.

- Consolidate overlapping tools in the same category.

- Negotiate discounts or longer terms for better pricing.

- Slow down net-new tool adoption while expanding usage of the winners.

The result? You might see who gets paid change, but overall software

spending still rises.

3. Automation as a Response to Labor Costs

Between wage inflation and talent shortages in key fields (engineering, security,

data, specialized operations), software became the preferred way to scale. If you

can avoid hiring ten extra operations specialists by investing in workflow automation

or low-code tools, that’s a trade many CFOs will happily make.

This is especially true in areas like:

- Customer support: chatbots, knowledge bases, and AI-assisted ticket routing.

- Revenue operations: forecasting, pricing intelligence, and pipeline hygiene tools.

- Security: automation in detection, response, and compliance reporting.

In this lens, Gartner’s 11.3% growth forecast isn’t about companies being generous

with budgetsit’s about them hunting for leverage.

4. Price Increases and “Invisible” Growth

One unglamorous but important factor: vendors raised prices.

Many large software providers announced price hikes in 2022–2023 to offset inflation

and increased infrastructure costs. When your primary vendors raise list prices by

5–10%, and you add a few more integrations or modules, your software budget grows

even if your headcount is flat.

That means part of the 11.3% growth is real volume and value, and part is pricing

and mix. From a buyer’s standpoint, it all shows up in the same line item.

Where the $880 Billion Was Going

Business software spend is not one big homogenous bucket. It’s a mosaic of categories

with very different dynamics. In 2023, several areas were especially important:

Core Enterprise Apps (ERP, CRM, HCM)

Big-ticket platforms like ERP and CRM continued to be the backbone of enterprise

software. Organizations invested in:

- Upgrading from on-premises systems to cloud-based versions.

- Integrating customer data across marketing, sales, and support.

- Modernizing financial and supply chain systems to handle volatility.

These projects are multi-year, high-stakes, and difficult to cancel midstream,

which makes them a stable source of software growth.

Cloud Infrastructure and Platform Software

Even before the full generative AI wave hit, organizations were buying cloud

platform services, databases, integration tools, and observability solutions at

a rapid clip. As applications moved to the cloud, the software needed to manage,

secure, and monitor those environments followed.

This layer also includes API management, developer productivity tools, and DevOps

platformsareas where incremental improvements can translate into faster shipping

cycles and lower failure rates.

Collaboration, Productivity, and Vertical SaaS

Hybrid work changed software portfolios permanently. Video conferencing, team chat,

shared documents, digital whiteboards, and project management tools all became

part of the standard stack. On top of that, vertical SaaS vendors built tailored

solutions for industries like construction, logistics, hospitality, and healthcare.

This is where the proliferation of tools became obvioussometimes painfully so.

Many companies found themselves with three or four overlapping collaboration apps,

multiple project tools, and a long tail of “shadow IT” subscriptions.

The Gartner forecast implied that, even as organizations cleaned up this sprawl,

the net effect would still be more spendjust concentrated in fewer, more strategic

products.

What Actually Happened After 2023

Fast forward: later Gartner and industry reports indicated that software

spending continued to grow beyond 2023, ultimately pushing toward and past

the $900 billion mark and setting the stage for software to exceed $1 trillion

annually. While growth rates shifted over time, the basic narrative remained:

software outpaced most other IT categories.

At the same time:

- Generative AI emerged as a new driver of software budgets.

- IT services and consulting grew as companies struggled to find enough in-house talent.

- Boards and regulators raised the bar on cybersecurity and compliance, driving more spend into those tools.

In hindsight, Gartner’s 11.3% forecast for 2023 looks less like a bold outlier and

more like the start of a longer trend: software has become the default way

businesses invest in change.

Implications for SaaS Founders and Revenue Leaders

So what does this mean if you’re building, selling, or buying software?

1. The Market Is Growing, But It’s Not Easy Money

Yes, the overall pie is expanding. But buyers are choosier than ever. Software

vendors that thrive in this environment tend to:

- Show clear, quantified ROI within a reasonable time frame.

- Integrate smoothly with existing systems to avoid adding friction.

- Offer flexible plans that adapt to changing headcount and usage.

- Provide strong onboarding and customer success to accelerate time-to-value.

It’s not enough to ride the market wave. You need to prove you’re the tool that

deserves to survive the next round of budget rationalization.

2. Land-and-Expand Beats Spray-and-Pray

With buyers under pressure, seat expansion inside existing customers is

often easier than winning brand-new logos. The smartest SaaS companies

used 2023–2024 to:

- Deepen adoption in their happiest accounts.

- Layer on adjacent features and modules that unlock more value.

- Align pricing and packaging with usage and outcomes.

In a world where software spend is still rising but scrutiny is intense, “love your

current customers” is not just a nice sloganit’s a survival strategy.

3. Buyers Want Fewer Vendors, Not More Tools

One repeating theme from 2023 software buying surveys: consolidation.

CIOs and CFOs alike want to reduce the number of vendors they manage, renegotiate

larger contracts, and simplify their stacks.

For vendors, that means:

- Becoming the “system of record” in your category instead of a niche add-on.

- Investing in integrations so you play nicely with other core systems.

- Positioning yourself as part of a strategic platform, not an isolated app.

For buyers, it means carefully deciding which vendors you’ll bet onand using

that leverage to demand better pricing, support, and product roadmaps.

500-Word Experience Deep Dive: Living Through the 11.3% Forecast

Numbers are helpful, but the real story of Gartner’s 11.3% software growth forecast

comes alive when you look at how different players actually experienced 2023.

Let’s zoom into three perspectives: the SaaS founder, the enterprise buyer, and the

investor.

The SaaS Founder: “Growing in a Headwind”

Imagine you’re running a mid-stage SaaS company in 2023. Your board is waving

the Gartner slide: “Look, software spend is still up 11.3%. The market is there!”

Meanwhile, your sales team is telling you deals are slipping, procurement cycles

are dragging out, and champions are suddenly nervous about sticking their necks out.

What you learn very quickly is that macro growth doesn’t erase micro friction.

Yes, budgets exist, but they’re being guarded carefully. Deals that used to close on

the VP’s signature now require CFO approval. Security reviews are stricter. Legal

wants more protective language. Proof-of-concepts and pilot phases become standard.

The founders who thrived leaned into discipline: tightening qualification criteria,

focusing on high-intent segments, and strengthening their ROI narratives with

customer benchmarks and case studies. They stopped treating Gartner’s forecast as a

guarantee and started treating it as a permission slip: the money is out there, but

you have to earn it.

The Enterprise Buyer: “Do More with the Same (or Less)”

On the other side of the table sits the CIO or VP of Operations. Their reality:

they’re under pressure to reduce risk, improve resilience, and support growthusually

without a matching increase in headcount. So they use Gartner data as one of several

inputs to justify where software can unlock real leverage.

In 2023, many buyers quietly reshuffled their stacks. They cut underused tools,

combined overlapping products, and renegotiated contracts. But they also approved

new investments where the business case was compelling: automation that replaced

manual workflows, analytics that uncovered revenue leaks, or platforms that

centralized scattered processes.

From their perspective, the 11.3% growth wasn’t about “spending freely.” It was

about spending surgically. Every new dollar had to either protect

the business or move it meaningfully forward.

The Investor: “Software Still Wins, But Selection Matters”

For investors, 2023 was a lesson in separating signal from noise. Public valuations

were down, late-stage funding was tighter, and yet underlying demand for business

software was still robust. That combination rewarded patience and punished momentum-only bets.

Investors who dove deeper than headlines saw that categories tied to clear ROI

(security, data, automation, core systems) remained strong, while speculative or

fringe tools struggled. They used Gartner’s forecast not as a blanket endorsement

of “all software,” but as a reminder that the right software still had room

to grow aggressively.

Put together, these perspectives make Gartner’s 11.3% forecast feel less like a

trivia fact and more like a snapshot of a turning point: a year when software

spending kept climbing, but the bar for value climbed even faster.

Conclusion: The Real Meaning of $880 Billion

Gartner’s call that business software spend would rise 11.3% to $880 billion in

2023 wasn’t just a forecastit was a diagnosis. It confirmed that even in turbulent

times, organizations see software as the primary way to adapt, automate, and grow.

For vendors, the takeaway is clear: you’re selling into a growing market,

but you’re also auditioning for a permanent role in a ruthlessly curated tech stack.

For buyers, it’s a reminder that software is now one of your most strategic levers

and that choosing the right platforms will shape your cost structure and agility for

years.

The headline number$880 billionis impressive. But the real story is what it

represents: a world where software is no longer a support function. It is

the business.