Table of Contents >> Show >> Hide

- Quick context: why Toast would even touch territories

- What Toast did (in plain English): raise closes, shrink coverage

- Why smaller territories can produce more closes

- The part nobody advertises: shrinking territories can upset everyone

- A practical playbook: how to shrink territories and still grow

- How to tell if “it worked” (without fooling yourself)

- So… should you copy Toast?

- Field Notes: Real-world experiences when territories shrink and close expectations rise

“We shrunk territories and told reps to close more” sounds like the corporate version of

“I cut your pizza slices smaller, so you’ll feel full faster.” Not exactly the stuff of morale posters.

And yet, Toast (yes, the restaurant tech companynot the breakfast) publicly signaled a version of this move,

and the early read was: it helped. The uncomfortable part? It makes sense.

Territory size and quota expectations are two of the biggest levers in go-to-market efficiency. Pulling both at once

is bold, bordering on chaotic. But when costs matter, growth expectations don’t chill out, and the business is chasing

profitability and expansion, bold starts to look like… necessary.

This article breaks down what Toast appears to have done, why smaller territories can produce more closes,

what can go wrong, and how to apply the same principles without triggering a mass exodus (or at least without

acting surprised when Slack gets spicy).

Quick context: why Toast would even touch territories

Toast sells an all-in-one restaurant platform: point of sale, payments, software subscriptions, and add-ons that help operators

run the business. Like many platform companies, its economics are a mix: software/subscription revenue tends to carry strong

gross margins, while payments can be lower-margin but huge in volume, and hardware/pro services can be a strategic on-ramp

that isn’t always profitable on paper.

In its public reporting for 2024, Toast posted substantial scale: annual gross payment volume (GPV) of $159.1 billion,

approximately 134,000 locations, and annual recurring revenue (ARR) of $1.6 billion. That’s the kind of footprint where

“sales efficiency” stops being a buzzword and becomes a board-level requirement.

When you have that kind of coverage, growth can’t rely on “hire more reps and hope.” It has to come from better productivity:

more wins per rep, faster cycles, smarter coverage, and less time wasted on non-selling work.

What Toast did (in plain English): raise closes, shrink coverage

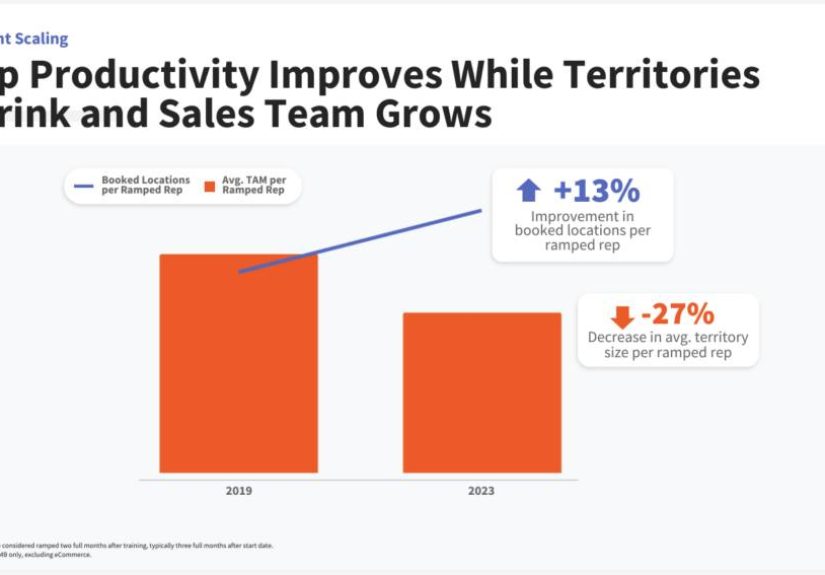

In public investor-day commentary, Toast was described as pushing two changes at the same time:

increasing the number of locations each sales rep needed to close (roughly a low-double-digit lift),

while also shrinking territories materially (roughly a quarter smaller).

Translation: “You’re responsible for fewer accounts/zip codes, but you’re expected to convert a higher share of what you’ve got.”

That’s not “work harder” in the abstractit’s “work denser.”

Why this combo is powerful

- Territory shrink reduces friction. Less travel, fewer dead-end accounts, fewer “I’ll get to it next week” gaps.

- Higher close expectations increase urgency. Reps prioritize pipeline movement over pipeline collecting.

- Together, they create focus. Focus is the cheapest productivity upgrade you’ll ever buy.

Why smaller territories can produce more closes

1) Density beats distance (and distance beats your calendar)

Field sales has a silent tax: travel time, scheduling gaps, and the “windshield problem” (time spent moving instead of selling).

Shrinking territories increases account density. Density means more conversations per day and less logistical drag.

There’s also a broader productivity reality: many sales orgs report that reps spend a surprisingly small share of their week

actually selling, with the rest eaten by admin, internal meetings, updates, and process tasks. If you can’t instantly remove

those tasks, you can still win by tightening the geography/coverage so selling moments happen more frequently.

2) Smaller territories raise “touch frequency” without feeling like extra work

The fastest deals often look boring on a dashboard: consistent follow-up, quick next steps, and fewer “stale” opportunities.

Smaller territories make it easier to:

- Revisit warm accounts quickly instead of “when I’m back in that area.”

- Run tighter neighborhood/market plays (think: restaurant clusters, shopping districts, downtown corridors).

- Stay top-of-mind with owners and managers who already have twelve vendors trying to “circle back.”

3) Territory shrink forces better qualification

When a rep has a massive patch, it’s easy to confuse activity with progress: lots of outreach, lots of “interested,”

lots of pipeline… and a lot of “ghosted.” With a smaller patch and a higher close target, reps are nudged (sometimes shoved)

into tighter qualification:

- Is this truly your ICP or just “a restaurant with a pulse”?

- Is there a real trigger (new location, ownership change, remodel, contract renewal, pain with current POS)?

- Are we getting to a decision-maker quickly, or collecting friendly non-decisions?

This is where productivity improvements can show up fastbecause you’re not waiting a quarter to learn you built a pipeline museum.

The part nobody advertises: shrinking territories can upset everyone

Territory changes can be a morale landmine. Reps interpret shrink as: “Management thinks we’re lazy,” even when the real intent

is: “We need a more efficient coverage model.”

Common failure modes

- Perceived unfairness. If high-potential pockets aren’t balanced, you create “princess territories” and “punishment territories.”

- Account confusion. Customers hate being reassigned every few months, especially mid-implementation or renewal.

- Ramp disruption. New reps need enough at-bats to learn. Shrink too soon and you starve the learning curve.

- Attrition. If comp doesn’t match the new reality, top reps will test the job market… immediately.

The fix isn’t to avoid change. The fix is to change like an adult: with data, clear rules, and a transition plan that respects

both customers and reps.

A practical playbook: how to shrink territories and still grow

Step 1: Define the “close unit” that matters

Toast’s world is locations. Your world might be logos, seats, MRR, transactions, or contracts. Pick one primary unit for productivity,

then decide the supporting metrics (pipeline created, meetings held, cycle time, win rate).

Step 2: Build a capacity model (before you draw lines on a map)

Territories should be sized by capacity, not vibes. A basic capacity model includes:

- How many qualified accounts a rep can actively work at one time

- Average touches needed to book a meeting

- Average meetings per close

- Average sales cycle length

- Travel/coverage time (for field roles)

If you shrink territory without checking capacity, you might accidentally create “too small to hit quota” patches.

That’s not a strategy. That’s a resignation letter generator.

Step 3: Balance by potential, not by count

Fifty tiny, low-potential accounts are not the same as fifty high-potential accounts. Balance territories using:

firmographics, historical spend, category fit, expansion signals, and competitive displacement likelihood.

Step 4: Decide what you’re optimizing for

Territory design is trade-offs. Be explicit about the priority order:

- Coverage quality: no “white space” in your best markets

- Workload balance: similar effort to achieve similar outcomes

- Customer experience: minimize unnecessary handoffs

- Seller efficiency: maximize selling time and reduce admin/travel drag

Step 5: Align quotas and comp to the new map

Shrinking territory and raising close expectations can work, but only if compensation and quota logic feel rational.

The simplest principle: if you’re asking for more output, make sure the path to earnings is still believable.

Consider guardrails like:

- Temporary spiffs for newly assigned accounts during the transition

- Short-term quota relief if a rep loses late-stage pipeline due to reassignment

- Clear rules of engagement (who owns what, when, and why)

Step 6: Operationalize the focus (or it won’t stick)

“Smaller territories” isn’t a plan. A plan includes:

- Weekly territory rhythms (top 25 accounts, top 10 opportunities, next-step discipline)

- Repeatable plays (new openings, remodel triggers, competitor replacement, multi-location expansion)

- Routing and batching (if you’re in the field, schedule like a surgeon, not like a tourist)

- Sales ops support that removes friction (clean data, automated assignment, fewer manual updates)

How to tell if “it worked” (without fooling yourself)

Don’t judge success by one quarter of revenue. Watch a balanced scorecard for at least a few cycles:

Seller productivity

- Closes per rep (or ARR per rep) per month

- Time-to-first-meeting and time-to-close

- Pipeline coverage quality (not just volume)

- Activity-to-outcome ratio (calls/visits per booked meeting, meetings per close)

Customer experience

- Implementation satisfaction during territory transitions

- Churn or dispute rates tied to handoffs

- Response times and escalation volumes

Business efficiency

- Sales and marketing cost trend relative to growth

- CAC payback and retention-adjusted LTV

- Ramp time for new reps in the new model

The goal is not to “squeeze reps.” The goal is to build a system where focus creates more selling time, more meaningful conversations,

and more closeswithout burning the team out.

So… should you copy Toast?

Copy the principle, not the headline. Toast’s public reporting shows a scaled business with a massive footprint, a push toward efficiency,

and strong recurring gross profit streams that benefit from disciplined go-to-market execution. In that context, tightening territories and

raising close expectations can be a lever that improves unit economics.

For your company, the “right” move depends on whether your current problem is:

- Coverage is too thin: you need smaller territories and higher touch frequency.

- Conversion is too weak: you need better qualification, coaching, and deal control.

- Process is bloated: you need to remove admin drag before asking for more closes.

- Territories are unfair: you need redesign before you change quotas.

If you do it right, the story becomes: “We gave reps a more focused patch and built a machine that helps them win more often.”

If you do it wrong, the story becomes: “We moved the goalposts and acted shocked when people left.”

Field Notes: Real-world experiences when territories shrink and close expectations rise

The first reaction is always emotional (and that’s normal)

The moment a territory map changes, every rep becomes a cartographer and a lawyer. People will zoom into county lines like they’re

reviewing a boundary dispute from 1847. Expect reactions like: “You took my best strip mall,” “You gave them the hotel cluster,” and

“Why does my patch look like a half-eaten pretzel?” Under the emotion is a real question: Will I still be able to hit my number?

If leadership can answer that with data and a believable plan, the volume drops quickly. If leadership answers with slogans, the job boards

start trending.

The “hidden win” is fewer half-started deals

In many teams, big territories create a pattern where reps start a lot of conversations but finish fewer. You’ll see dozens of accounts

with one call logged and no next steppipeline confetti. When territories shrink, reps naturally revisit the same accounts faster. Follow-ups

happen sooner, demos get scheduled tighter, objections get handled while they’re still warm, and “circle back next month” turns into

“let’s decide by Friday.” The improvement can feel magical, but it’s really just physics: less distance between touchpoints.

Managers have to coach differently

With larger territories, coaching often centers on activity: more outreach, more visits, more top-of-funnel. With smaller territories and

higher close expectations, coaching shifts toward conversion: tighter discovery, stronger deal plans, better next-step control, and clearer

mutual action plans. The best managers stop praising “busy” and start praising “moved.” Moved stages. Moved decisions. Moved timelines.

That shift can be uncomfortable for teams used to celebrating volume, but it’s where the performance gains stick.

Territory shrink exposes data problems fast

If your CRM has duplicates, missing addresses, messy ownership rules, or outdated account statuses, territory redesign will drag those issues

into the daylight like a raccoon tipping over a trash can. Teams often discover they’ve been “counting” accounts that can’t buy, already churned,

or aren’t in the ICP at all. The upside: once you clean the data, the territory plan becomes fairer, forecasts improve, and reps stop wasting time.

The downside: you’ll wish you did this earlier.

Customers notice handoffs more than you think

Internally, a territory shift can feel like a spreadsheet update. Externally, it can feel like, “Wait, who are you and why are you calling me

about something I already discussed with someone else?” The smoothest transitions treat the customer relationship like a relay race: warm intro,

clear context, and a short overlap period. The worst transitions treat it like musical chairs, where the music stops mid-implementation.

If you’re going to shrink territories, protect in-flight deals and existing customers with handoff rules that prioritize continuity.

The long-term payoff is a “territory business” mindset

When reps have a focused patch, the best ones stop thinking like lead-chasers and start thinking like local operators. They learn the patterns

of their market: which neighborhoods are opening new concepts, which owners are expanding, which competitors are weak, and which seasonal events

spike demand. That local intelligence compounds. Over time, the rep becomes a specialist, win rates rise, referrals increase, and the territory

behaves less like a random set of accounts and more like a mini portfolio. That’s the moment where “smaller territory” stops sounding like a cut

and starts sounding like an advantage.