Table of Contents >> Show >> Hide

- What “Multi-Product” Actually Means (And What It Doesn’t)

- Why SaaS Companies Go Multi-Product (Besides “Because It Sounds Cool”)

- The Readiness Checklist: Earn the Right to Go Multi-Product

- 7 Signals It’s Time to Go Multi-Product

- 1) You’re “pedaling at half speed” on the core product

- 2) Customers keep asking for the same adjacent workflow

- 3) Your best customers outgrow the core use case

- 4) Your growth math starts leaning too hard on expansion alone

- 5) You’re approaching the “scale threshold” where multi-product becomes common

- 6) Competitive dynamics are shifting toward suites

- 7) You have a clear “platform loop”

- When You Should Not Go Multi-Product

- Pick the Right Multi-Product Path (So You Don’t Build “Random Product #2”)

- Path A: Add-on first (the “low drama” option)

- Path B: Adjacent workflow for the same ICP (the “land-and-expand” amplifier)

- Path C: “Layer cake” in vertical SaaS (the “same customers, more of their P&L” strategy)

- Path D: Platform modules (the “compounding data + workflow loop”)

- Path E: Acquisition (the “fast forward” button)

- How to Make Multi-Product Actually Work (Operationally, Not Just Philosophically)

- Real-World Examples of Multi-Product Done (Mostly) Right

- A Simple Decision Framework: The 4-Question Test

- A Practical 90-Day Plan Before You Announce Anything

- Conclusion: Multi-Product Is a Strategy, Not a Hobby

- Field Notes: What Going Multi-Product Feels Like (The Part Nobody Puts on the Slide)

- SEO Tags

The dream: your SaaS becomes a “platform.” Customers buy more, churn less, and your revenue chart starts doing that

satisfying hockey-stick thing instead of the “slightly optimistic ski slope” thing.

The nightmare: you launch Product #2, your team’s attention shatters into a thousand Jira tickets, your sales reps

ignore the new thing (because quotas are real and dreams are free), and your once-crisp positioning turns into a

homepage that reads like a buffet menu.

Going multi-product is one of the most powerful moves in SaaSand one of the easiest ways to accidentally

turn a focused company into a feature mall. This guide breaks down when to go multi-product in SaaS,

how to spot the right moment, and how to do it without setting your roadmap on fire.

What “Multi-Product” Actually Means (And What It Doesn’t)

Let’s get one thing straight: adding a couple of features is not “multi-product.” That’s just… Tuesday.

A multi-product SaaS typically means you have distinct offerings that can stand on their own in

packaging, value, and (often) buying decisions.

Common multi-product shapes

-

Add-ons: A clearly defined extra that a meaningful chunk of customers buy (think “power” features

or modules that bolt onto the core product). -

Adjacent products for the same ICP: A new product that solves a neighboring workflow for the same

kind of customer (same world, same language, same pain). -

Suite/platform modules: Multiple products that share data, integrations, admin controls, and a

unified customer value story (the “platform” label starts to become earned). -

Acquired products: You buy your way into a second product (fast!), then spend the next 18 months

merging billing systems (less fun!).

The key distinction is this: a multi-product strategy should create compounding valueshared data,

shared distribution, shared trust, shared outcomesnot just more stuff to maintain.

Why SaaS Companies Go Multi-Product (Besides “Because It Sounds Cool”)

The strongest reasons to expand your product portfolio are all variations of one theme:

you’re trying to grow without re-paying the entire cost of growth every year.

1) Increase revenue per customer (without doubling CAC)

Winning a customer is expensive. Expanding that customer is usually cheaperespecially if you’re selling

complementary products to an audience that already trusts you.

2) Expand TAM without abandoning your strengths

A second (or third) product can widen your total addressable market while keeping your brand anchored in the space

where you already have credibility.

3) Improve retention by becoming harder to replace

If your products share data, workflows, and outcomes, you can become embedded in how work gets done. That’s stickier

than being “the tool we use for one task.”

4) Build a real platform advantage

Platform companies get stronger as they ship new modules because each module deepens the data, integrations, and

customer relationship. In other words: the whole becomes more than the sum of the parts.

The Readiness Checklist: Earn the Right to Go Multi-Product

Before you introduce Product #2, check if you’ve earned the right to do it. Not in a “you deserve it!” waymore in

a “your organization can survive it” way.

Your core product should be boringly healthy

- Retention is solid: Customers stay, renew, and actually use the product.

- ICP is crisp: You can describe your best-fit customers without using interpretive dance.

- Positioning is working: Prospects “get it” quickly; your pipeline isn’t entirely explained by heroics.

- Delivery is predictable: Shipping isn’t a monthly surprise party with a different theme each time.

Your go-to-market motion can absorb complexity

- Sales/CS capacity exists: Someone can actually sell/enable/support Product #2.

- Customer expansion muscle is real: You can identify expansion opportunities and execute them.

- Billing and packaging are not a disaster: Because multi-product pricing can turn into a soap opera fast.

Your data and product foundation can support a suite

- Shared identity/admin: SSO, permissions, governanceespecially if you sell mid-market/enterprise.

- Shared data model (or a plan): Multi-product is way easier when products connect naturally.

- Integration strategy: You know how products will work together and why customers should care.

7 Signals It’s Time to Go Multi-Product

There’s no universal number that magically declares “you are now ready.” But there are reliable signals that your

business is approaching the multi-product inflection point.

1) You’re “pedaling at half speed” on the core product

Growth is still healthy, but the next tranche of growth is harder. You’re not dyingyou’re maturing.

This is often the best time to place a second bet, because you still have momentum and resources.

2) Customers keep asking for the same adjacent workflow

Not “can you add this feature?” But “we need you to solve this other problem right next door.”

Repeated demand from your happiest customers is a giant neon sign that says: “Expansion path found.”

3) Your best customers outgrow the core use case

The most successful accounts start building spreadsheets, workarounds, or buying another tool to handle the next

step in the workflow. That “other tool” is either your future product… or your future competitor’s wedge.

4) Your growth math starts leaning too hard on expansion alone

As companies scale, new-logo growth often slows. Expansion becomes more important. A multi-product portfolio can

provide more legitimate ways to expand accountswithout turning your core product into a Frankenstein of features.

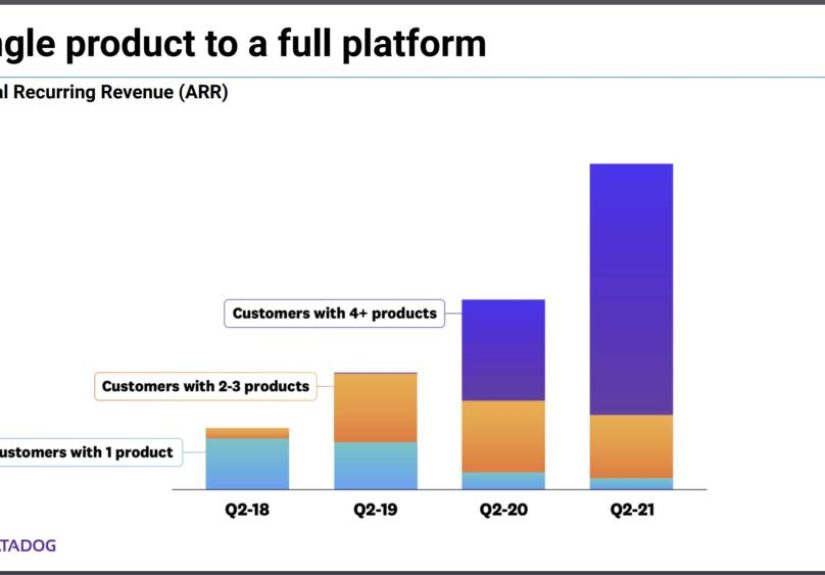

5) You’re approaching the “scale threshold” where multi-product becomes common

Many operators cite rough stage markers where multi-product becomes increasingly necessary to sustain top-tier growth.

These aren’t laws of physics, but they’re useful sanity checksespecially if your peers at similar scale are making

the jump.

6) Competitive dynamics are shifting toward suites

If buyers are consolidating vendors, procurement is tightening, or competitors are bundling aggressively, a focused

single-product strategy can become a disadvantageunless your product is so dominant it can stand alone forever

(which is… rare).

7) You have a clear “platform loop”

If every new product can reuse your core data, workflows, distribution, integrations, and brand trust, you may be

building a compounding platform rather than a collection of random tools.

When You Should Not Go Multi-Product

Some “reasons” are actually warning signs in a trench coat.

Red flags that scream “not yet”

-

You’re trying to escape a struggling core product: Product #2 is not a life raft. It’s more like a second

boat you also have to row. -

Your ICP is still fuzzy: If you can’t reliably win and retain one customer type, a second product often

expands confusion, not revenue. - Your roadmap is already overwhelmed: Multi-product magnifies prioritization problems.

-

Your org can’t support two bets: If you don’t have leaders who can own Product #2 end-to-end, it becomes

an orphaned initiative powered by meetings. -

You’re chasing a totally different buyer too early: Selling to a new persona/department sounds exciting.

It’s also a brand-new go-to-market motion.

Pick the Right Multi-Product Path (So You Don’t Build “Random Product #2”)

The best multi-product portfolios aren’t accidental. They follow a deliberate pattern based on customer pull and

platform leverage.

Path A: Add-on first (the “low drama” option)

Add-ons are often the safest entry point: you learn packaging, cross-sell, enablement, and multi-product support

without reinventing your entire company.

The litmus test: can the add-on be understood quickly, sold alongside the core, and adopted by a meaningful

percentage of customers without a brand-new GTM machine?

Path B: Adjacent workflow for the same ICP (the “land-and-expand” amplifier)

This is the classic “suite grows around a system of record” move. You start with one job-to-be-done, then expand to

the next jobs your customers must solve.

Path C: “Layer cake” in vertical SaaS (the “same customers, more of their P&L” strategy)

In vertical SaaS, companies often add products that map to more lines of the customer’s operating modelsometimes

including integrated services (like payments) that feel seamless because the vendor already owns the workflow.

Path D: Platform modules (the “compounding data + workflow loop”)

This is where multi-product becomes a true platform play: shared identity, shared data, shared integrations, shared

admin, and a clear narrative that the products work better together.

Path E: Acquisition (the “fast forward” button)

Acquiring a second product can be efficient, but the hidden cost is integration: product experience, brand

architecture, billing, support, and internal ownership.

How to Make Multi-Product Actually Work (Operationally, Not Just Philosophically)

Multi-product strategy fails in very predictable waysusually in the “execution layer.”

Here’s how to avoid the classics.

1) Start with the same happiest customers

The easiest expansion is “more value for people who already love you.”

If you launch Product #2 to a brand-new audience first, you’re basically starting a second startup.

2) Give Product #2 a real owner (not a committee)

Multi-product companies work when each product has accountable leadershipsomeone who wakes up thinking about

product adoption, roadmap, GTM, and results. Otherwise, Product #2 becomes a “side quest” that never ships.

3) Keep packaging simple: a la carte + bundles + a clear suite

Customers want options, but they also want clarity. A practical approach is:

- A la carte: Customers can buy a single product if that’s all they need.

- Bundles: Pair complementary products for a clear outcome (and a clear price advantage).

- Suite: A premium “all-in” option for customers who want consolidation and governance.

The goal is to avoid “pricing spaghetti,” where every customer has a unique deal that only one person in Finance

understands (and they’re on vacation).

4) Build a cross-sell motion like it’s a product

Cross-selling is famously harder than leaders expect. Treat it like a change program:

messaging, enablement, incentives, and clear “who sells what to whom, and when.”

5) Invest in the “shared layer” early

Multi-product feels magical when customers experience one login, consistent navigation, shared data, unified admin,

and products that naturally connect. It feels painful when it’s five separate tools with matching logos.

Real-World Examples of Multi-Product Done (Mostly) Right

Atlassian: suite value through connected work products

Atlassian’s ecosystem shows how multiple products can support a broader “work management” narrative. Bundling and

suite offerings can reduce friction for customers who want multiple workflows covered under one umbrella.

HubSpot: multiple “Hubs” around a unified customer platform

HubSpot’s product structure illustrates a platform story: marketing, sales, service, content, and operations

components that are more valuable when unifiedespecially for teams trying to reduce tool sprawl.

Salesforce: cloud modules with a platform backbone

Salesforce is the classic modular suite approach: multiple “clouds” sold into different needs, anchored by shared

data and platform capabilities that support enterprise governance.

Vertical SaaS “layer cake”: expand across the customer’s operating stack

Many vertical leaders expand by stacking adjacent products that map to additional parts of the customer’s workflow

and economics. The advantage: you already speak the customer’s language and understand their process deeply.

A Simple Decision Framework: The 4-Question Test

If you’re debating when to go multi-product in SaaS, run your idea through these four questions.

If you can’t answer them clearly, you’re not “not ready” foreveryou’re just early.

1) Customer pull: is there a repeatable, urgent demand?

- Do your best customers ask for it without prompting?

- Is it tied to outcomes they already pay you for?

- Would they buy it this year, or is it “nice someday”?

2) Platform leverage: does it reuse your strengths?

- Can it share data, identity, integrations, or workflows?

- Does it get meaningfully better because your core product exists?

- Does your distribution (sales, PLG, partners) naturally fit it?

3) Organizational capacity: can you do two things well?

- Do you have a real owner for Product #2?

- Can you fund it without starving the core?

- Can your GTM team actually sell and support it?

4) Timing window: are you early enough to benefit, not so late you’re forced?

- Are you still growing strongly in the core while you place the next bet?

- Will it take 12–24 months to reach meaningful revenue?

- Are you acting proactively, not reactively?

A Practical 90-Day Plan Before You Announce Anything

The biggest multi-product mistake is announcing a “platform strategy” before you’ve validated the actual product.

Here’s a practical pre-launch sequence.

Days 1–30: validate the adjacent problem (hard)

- Interview best customers and lost deals.

- Define the smallest “standalone value” version of Product #2.

- Identify the buyer, the champion, and the day-to-day user.

Days 31–60: prototype the workflow and packaging (awkward but necessary)

- Ship a narrow beta to 5–10 ideal accounts.

- Test willingness-to-pay and packaging (don’t skip this).

- Define how Product #2 connects to Product #1 (data, UI, admin).

Days 61–90: build the go-to-market “attach” motion

- Create a clear cross-sell story and enablement materials.

- Decide who owns expansion: sales, CS, or product-led motion (or a blend).

- Set early targets: adoption, attach rate, activation, and retention for Product #2.

Conclusion: Multi-Product Is a Strategy, Not a Hobby

The best time to expand is usually after your core product is undeniably working and

before growth slows enough that you’re forced into a rushed second bet.

If you have strong customer pull, clear complementarity, platform leverage, and the organizational capacity to run

two bets in parallel, going multi-product can widen TAM, deepen retention, and create compounding advantage.

But if you’re chasing novelty, escaping core product problems, or trying to sell to a brand-new audience without

the right GTM musclewait. Your future platform will thank you. Your present roadmap will also thank you. Probably

with fewer emergency meetings.

Field Notes: What Going Multi-Product Feels Like (The Part Nobody Puts on the Slide)

In theory, going multi-product sounds like a confident walk onto a bigger stage. In practice, it often starts with a

very human moment: someone on the leadership team says, “We should build X,” and the room nods like it’s obvious.

Then the PM quietly asks, “Who is ‘we’?” and the CFO quietly asks, “What is ‘build’?” and Sales quietly asks,

“Does this affect my quota this quarter?”

The earliest “experience” many SaaS teams report is a weird emotional split: excitement and dread showing up to the

same meeting. Excitement because Product #2 is a fresh bet, and fresh bets are where founders get their energy back.

Dread because everyone can feel the complexity tax approachinglike thunder in the distance, but the thunder is

named “support tickets” and “pricing exceptions.”

The teams that do well often describe a turning point: they stop treating Product #2 as a shiny object and start

treating it as a customer expansion pathway. That shift changes everything. Instead of “What do we

want to build?” it becomes “What do our best customers keep needing right after they succeed with Product #1?”

That question tends to produce calmer roadmaps, cleaner positioning, and fewer late-night Slack debates about whether

you’ve created a “new product” or just an “enthusiastic feature.”

Another universal experience: the first time your team tries to package and price multiple products, you discover

that pricing is not mathit’s psychology wearing a spreadsheet costume. Customers want flexibility, Sales wants

deals, Finance wants consistency, and Product wants “value-based pricing” (which is noble, but also vague enough to

be used as a sleep aid). The most effective teams pick a simple structuresingle products, a couple of bundles, and

a clear suiteand refuse to turn every edge case into a new SKU. They accept that the goal isn’t perfect pricing;

it’s pricing that customers understand and your business can operate.

Then there’s the go-to-market reality check. The first month after launch, Product #2 gets a lot of internal love

and not much external traction. This is normal. What separates winners is whether they build a repeatable “attach”

motion. They define the right trigger moments (“when a customer does X, they’re ready for Y”), they enable CS and

Sales with simple talk tracks, and they make adoption measurable. If the motion is real, you’ll hear it in customer

language: “Oh, that’s exactly what we needed next.” If it’s not, you’ll hear polite phrases like: “Interesting… we’ll

circle back.”

Finally, the best multi-product stories tend to share one humble detail: the company didn’t magically become a

platform on launch day. It became a platform over time, by investing in the shared layeridentity, admin,

data, integrations, and a unified narrative that connects the products into outcomes customers care about. And yes,

it’s less glamorous than announcing “Platform 2.0.” But it’s also the part that makes customers stick around long

enough to buy Product #3, which is when everyone starts acting like this was the plan all along.