Table of Contents >> Show >> Hide

- What “Animal Spirits” Really Means (And Why Markets Keep Acting Like Humans)

- The 2020 Day-Trader Comeback: Why the Fire Caught So Fast

- “Free Trading” Isn’t FreeIt’s Just Priced Differently

- The Evidence Problem: Why Most Day Traders Don’t “Graduate” Into Consistent Winners

- The Rules Behind the Curtain: Pattern Day Trader, Margin, and “WaitMy Account Is Restricted?”

- Betterment vs. Robinhood: Two Stories About Who You Want to Become

- How to Channel Animal Spirits Without Letting Them Drive the Car

- Conclusion: The Real Lesson of “10,000 Day Traders”

- Experiences From the “10,000 Day Traders” Era (And What They Teach You)

In July 2020, the market served up a headline that sounded like it was written by a caffeinated screenplay writer:

“ten thousand day traders are buying Tesla every hour.” That one line captured an entire vibelockdowns,

stimulus checks, commission-free apps, and a global audience bored enough to turn candlestick charts into a spectator sport.

It also captured something economists have been arguing about for nearly a century: markets aren’t powered only by math.

They’re powered by mood.

That mood has a name: animal spirits. It’s the cocktail of optimism, fear, confidence, and “I watched two TikToks so I’m basically a hedge fund now.”

In the Animal Spirits episode “10,000 Day Traders,” the conversation bounces from mortgages and real estate to mega-cap dominance and the comeback of retail traders.

But the day-trader number is the hook because it forces a bigger question:

when the crowd gets loud, are you investing… or just feeling things?

What “Animal Spirits” Really Means (And Why Markets Keep Acting Like Humans)

“Animal spirits” is shorthand for the emotional fuel that drives economic decisionsespecially when the future is uncertain.

In markets, it shows up as confidence that turns into risk-taking, fear that turns into panic selling, and the strange

social phenomenon where everyone suddenly has “a take” on the same stock at the same time.

When animal spirits run hot, narratives get simpler and louder:

“This time is different,” “the dip is free money,” “the Fed has my back,” “this company is changing the world,”

or the classic, “I’m not late, I’m early.” (That last one is how people describe being late.)

These stories can move prices because people move pricesespecially when trading is easy, fast, and cheap.

The key point

Animal spirits aren’t automatically “bad.” They’re part of what makes markets liquid and entrepreneurial.

The problem is when emotions start masquerading as a strategy. That’s when a portfolio becomes a mood ring.

The 2020 Day-Trader Comeback: Why the Fire Caught So Fast

The “10,000 day traders” moment didn’t happen in a vacuum. 2020 was the perfect storm:

lots of time at home, huge news cycles, volatile markets, historically low rates, and apps that turned trading into

something that felt closer to a game than a spreadsheet.

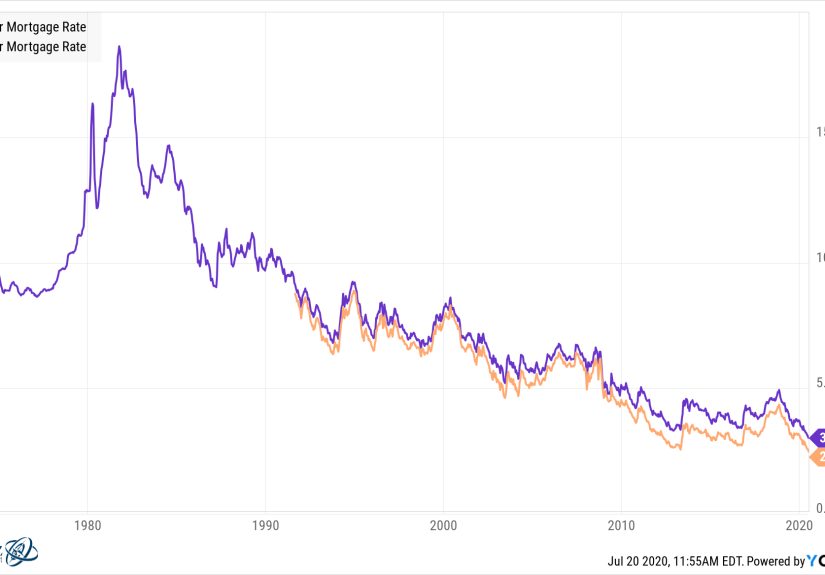

In the show notes for “Animal Spirits: 10,000 Day Traders,” the discussion touches everything from record-low mortgage rates

to whether real estate might outperform in the 2020s, and whether markets were already “pricing in” a vaccine.

But one bullet point stands out because it’s so direct:

retail traders were coming back “with a vengeance.”

Tesla as the mascot of the moment

Tesla became a symbolnot just of innovation, but of momentum culture.

Reports at the time described massive bursts of retail buying activity, including a surge of Robinhood accounts adding shares

in a short window. Whether you loved the company or rolled your eyes at the hype, Tesla was a perfect “animal spirits” canvas:

charismatic CEO, big dreams, big price swings, and a narrative that could fit inside a meme.

And here’s the uncomfortable truth: volatility attracts attention, attention attracts traders, and traders can amplify volatility.

That doesn’t mean the crowd is always wrongit means feedback loops are real.

“Free Trading” Isn’t FreeIt’s Just Priced Differently

Commission-free trading lowered the barrier to entry, and that’s mostly a good thing.

But it also changed how trading feels. When the obvious fee disappears, the brain quietly assumes the activity is harmless.

That’s great for trying a new restaurant. It’s less great for clicking “buy” on something that can drop 15% before lunch.

Many brokers make money in ways that aren’t as visible as a $9.99 trade ticket used to belike payment for order flow,

margin lending, and premium features. None of this automatically means you’re getting ripped off.

It means the cost is easier to ignore, and ignored costs have a habit of showing up later disguised as “why is my performance so weird?”

The sneaky costs traders underestimate

- Execution quality: tiny price differences can matter when you trade frequently.

- Spreads and slippage: “I bought at $100” is sometimes more like “I bought near $100… spiritually.”

- Taxes: short-term gains in the U.S. are generally taxed like ordinary income, which can surprise people who thought profits were “clean.”

- Opportunity cost: time spent chasing noise is time not spent building a plan.

The Evidence Problem: Why Most Day Traders Don’t “Graduate” Into Consistent Winners

Day trading has an irresistible storyline: skill, hustle, independence, and quick feedback.

But the data is famously unromantic. Multiple lines of research have found that frequent traders tend to underperform,

often by enough that it’s hard to explain away as bad luck.

One reason is simple arithmetic: if trading were easy, it wouldn’t pay. Markets are competitive.

By the time a pattern is obvious, it’s usually already crowded. Add costsspreads, slippage, taxes, mistakesand the hurdle gets higher.

Studies on day trading specifically have found that a very small fraction of traders show persistent, repeatable outperformance net of fees.

Everyone else is fighting a battle where the enemy is partly the market and partly their own brain.

Overconfidence: the most expensive emotion on Wall Street

A lot of people don’t start day trading because they love risk. They start because they believe they’ve found an edge:

better instincts, better information, better timing. That belief is incredibly human.

It’s also the reason many traders increase size at the exact moment they should be increasing humility.

To be clear: some people are skilled. But the odds are not evenly distributed, and the market doesn’t hand out participation trophies.

The “10,000 day traders” headline is a reminder that crowds can form faster than skill can develop.

The Rules Behind the Curtain: Pattern Day Trader, Margin, and “WaitMy Account Is Restricted?”

Here’s the part beginners often learn the hard way: U.S. markets have rules that matter more when you trade a lot.

The big one is the Pattern Day Trader (PDT) designation.

If you place enough day trades in a margin account over a short window, broker-dealers may flag you as a pattern day trader,

and then additional minimum-equity and margin requirements kick in.

This isn’t just bureaucratic trivia. It’s about leverage and settlement risk.

Day trading often involves borrowing (margin) or using products that behave like leverage (options, leveraged ETFs).

That can magnify gains, but it can magnify losses faster than your emotions can refresh the page.

One practical takeaway

If you don’t fully understand how margin calls work, you’re not “taking calculated risk.”

You’re playing financial Jenga with one hand and refreshing your P&L with the other.

Betterment vs. Robinhood: Two Stories About Who You Want to Become

One of the most interesting “Animal Spirits” contrasts is Betterment vs. Robinhoodnot as brands,

but as philosophies.

-

The Betterment mindset: automate the boring stuff, diversify, rebalance, and let time do the heavy lifting.

It’s not thrilling. That’s the point. -

The Robinhood mindset: markets are accessible, participation is empowering, and trading is engaging.

It can also make “engaging” feel like “urgent,” which is where trouble starts.

The punchline isn’t that one is “good” and the other is “bad.”

The punchline is that your tools shape your behavior. If your investing app feels like a casino lobby,

don’t be shocked when you start thinking in casino time.

How to Channel Animal Spirits Without Letting Them Drive the Car

If you take anything from the “10,000 day traders” story, let it be this:

emotion is inevitableautomation and rules are optional.

You don’t need to eliminate excitement; you need to stop excitement from setting the agenda.

Build guardrails that are boring on purpose

- Separate “fun money” from “future money” so your retirement doesn’t depend on your Tuesday mood.

- Write down your rules (yes, like a grown-up) before you place trades, not after you regret them.

- Measure behavior, not just results: did you follow your process, or did you chase a feeling?

- Respect your life stage: if you’re under 18, focus on learning and simulationreal accounts have real consequences.

Markets will always tempt you with the highlight reel. The discipline is choosing the boring, repeatable play

that you can stick with when the highlight reel goes quiet.

Conclusion: The Real Lesson of “10,000 Day Traders”

“10,000 day traders” isn’t just a statit’s a snapshot of collective psychology.

It shows how quickly participation can surge when friction disappears, and how easily confidence turns into crowd behavior.

The bigger story is not Tesla, or mortgages, or mega-cap domination. The bigger story is that markets are social,

emotional systems with price tags attached.

If you want a sustainable relationship with money, treat animal spirits like weather:

notice them, plan for them, and don’t let them convince you that today’s temperature is your permanent personality.

The goal isn’t to feel nothing. The goal is to feel something and still make decisions you won’t hate later.

Experiences From the “10,000 Day Traders” Era (And What They Teach You)

If you were anywhere near finance Twitter, Reddit, or group chats in 2020, you saw the same storyline play out in different costumes.

Someone downloads a trading app “just to learn.” They buy a familiar nameTesla, Apple, something that feels like it belongs in the future.

The price moves fast. Their phone lights up. A green number appears. Suddenly, investing feels like a talent show and the market just hit the buzzer.

That first win is powerful because it doesn’t feel like luck; it feels like proof.

People start talking in confident sentences: “It’s obvious,” “you can’t lose,” “I should’ve bought more.”

And then the market does what markets do: it changes the rules mid-game. The stock drops. The same app that made you feel like a genius

now makes you feel personally insulted. You didn’t just lose moneyyou lost the story you were telling yourself about who you are.

One common experience from that era was how quickly identity got tied to a ticker symbol.

You weren’t just “owning Tesla”; you were “a Tesla person.” You weren’t just “watching markets”; you were “early.”

The community vibe made it feel social, almost like cheering for a team. That’s the upside and downside of crowds:

they make you feel brave when you should be cautious, and ashamed when you should be calm.

Another pattern: people discovered the difference between being right and making money.

You could be correct about a company’s long-term future and still get steamrolled in the short term if you used leverage,

chased momentum, or sized up based on vibes. Many traders learned (often painfully) that timing is a separate skill from analysis.

And timing is brutally hard because it’s competing against professionals, algorithms, and millions of other humans with the same chart open.

There was also the “24/7 brain” effect. Even when markets weren’t open, the news cycle was. The group chats were.

The memes were. You could always find another reason to check prices, another hot take, another thread that sounded like certainty.

The constant stimulation made it easier to confuse activity with progresslike running on a treadmill and calling it a road trip.

The healthiest experience many people reported later wasn’t “I found the perfect trade.”

It was: “I built a system that made me less reactive.” Some moved most of their money into boring, diversified investing and kept a small

sandbox for curiosity. Others stopped trading during work hours because it turned them into an emotional yo-yo.

Many realized their best financial move wasn’t predicting the next candleit was increasing savings, paying down expensive debt,

and investing consistently. Not glamorous, but effective. Like flossing. For your portfolio.

The “10,000 day traders” moment is ultimately a reminder that financial markets don’t just reflect the economy.

They reflect attention. And attention is contagious. If you take that lesson seriously, you don’t have to fear the crowd

you just have to stop letting the crowd borrow your steering wheel.