Table of Contents >> Show >> Hide

- Wages vs. Prices 101: What “Getting Ahead” Really Means

- Why So Many People Still Feel Behind

- The Lucky Ones: When Pay Beats Inflation

- What Determines Whether Your Pay Keeps Up

- What If Your Pay Isn’t Keeping Up?

- If Your Pay Rose Faster Than Prices, You’re LuckyNow Use It Well

- Big Picture: The Economy vs. Your Personal Reality

- Experiences from the Real World: What It Feels Like When Pay Finally Beats Prices

If your paycheck has grown faster than prices over the last few years, take a moment to appreciate it.

In an economy where groceries seem to cost more every week and rent renewals arrive with a jump scare,

having your pay outrun inflation is a little bit like finding a winning lottery ticket in your coat pocket

rare, exciting, and slightly unbelievable.

But what does it actually mean for your pay to beat inflation? Why does it feel like so many people

are still falling behind, even when headlines talk about “strong wage growth”? And if you are one of

the lucky ones whose income is finally outpacing rising prices, what should you be doing with that edge?

Wages vs. Prices 101: What “Getting Ahead” Really Means

Let’s start with the basics. Your nominal wage is the number you see on your paycheck:

$20 an hour, $65,000 a year, whatever the case may be. Your real wage is that paycheck

adjusted for inflationessentially, how much stuff your money can actually buy.

If your pay goes up 3% but prices go up 5%, your real wage is actually down. You’re technically

earning more dollars, but each dollar is weaker. On the other hand, if your pay goes up 4% and prices

rise 2%, your real wage grew about 2%. That’s the “I can finally breathe a little” feeling people talk about.

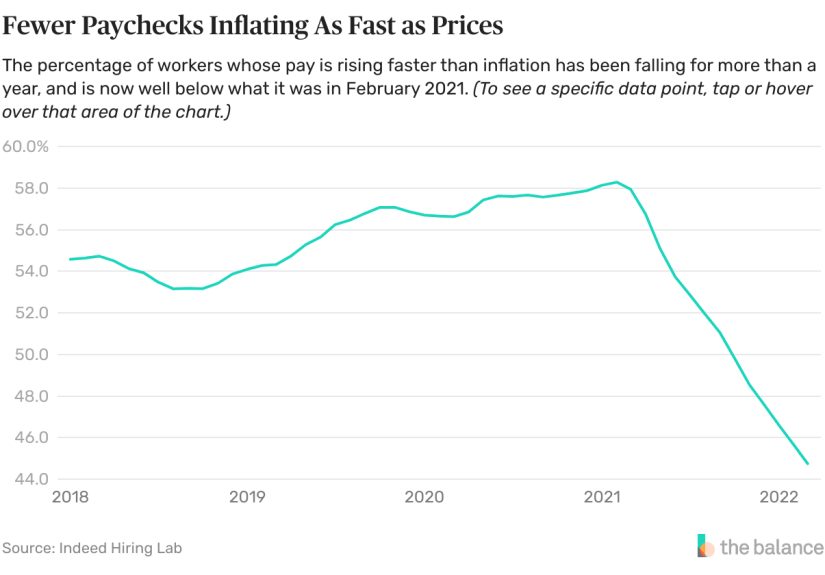

Recent U.S. data shows how rare that feeling has been. After the big inflation spike that began in 2021,

price growth outpaced wage growth for a while, which meant that the average worker was losing purchasing

power even as paychecks got bigger. More recently, government statistics show that

real average hourly earnings have started to rise againbut only modestly, often around

1% or so year over year. That’s progress, but it’s hardly a windfall.

Why So Many People Still Feel Behind

If you’ve heard that “wages are finally beating inflation” and your first reaction was,

“Then why am I still broke?”, you are far from alone.

Surveys in 2025 from major financial sites show that nearly two-thirds of workers say their

pay has not kept up with inflation over the past year, even though more than half

did receive some kind of raise. The problem is that those raises often barely cover the higher cost

of basics like rent, groceries, utilities, and transportation.

Official income statistics tell a similar story. When you adjust for inflation, the typical full-time,

year-round worker in the U.S. is earning less today than in 2021. Median earnings may have ticked up in

dollar terms, but once you factor in higher prices, many households are running just to stay in place.

That gap between how the economy looks “on paper” and how it feels in your wallet is why so many people

are frustrated. The job market might be relatively strong, unemployment reasonably low, and average wages

technically risingbut if your rent and your grocery bill jumped faster than your paycheck, you’re not

imagining it: you are worse off in real terms.

The Lucky Ones: When Pay Beats Inflation

Now for the hopeful part: not everyone is falling behind. In fact, there are pockets of workers whose

pay has indeed risen faster than prices. If you’re in that group, yes, you’re luckybut it’s not all luck.

Economic analyses of recent years show that:

-

A majority of job changers during the post-pandemic period saw their real wages rise

faster than inflation as they moved into higher-paying roles. -

Low-wage workers, especially in industries like hospitality and retail, experienced

unusually strong raises between 2019 and 2023 as employers scrambled to fill open positions. In real

terms, their pay grew by double-digit percentages over that period. -

Across all workers, there have been stretcheslike the most recent run since 2024where

average wages outpaced inflation month after month, giving the typical worker a small

but real bump in purchasing power.

Policy think tanks and labor researchers estimate that during some of these stronger periods,

more than half of workers saw their personal paychecks outstrip inflation. Those are the moments when

debt payments feel lighter, saving feels possible, and you can splurge on the occasional non-essential

without doing budget gymnastics.

If you landed a big promotion, switched to a better-paying employer, moved into a high-demand field,

or finally negotiated that raise you’d been putting off, you may have jumped ahead of the crowd.

That’s partly a reward for good timing and smart movesand partly just the randomness of being in

the right sector, at the right time, in the right place.

What Determines Whether Your Pay Keeps Up

1. Your Industry and Occupation

Not all jobs are created equal when it comes to wage growth. Workers in tech, finance, health care,

and certain skilled trades have often seen pay increases that outpace inflation, especially when there’s

a shortage of qualified people. In contrast, workers in fields with lots of competition, limited bargaining

power, or heavy cost-cuttinglike some service or clerical rolesmay see raises that barely cover rising prices.

During the pandemic and its aftermath, for example, wage growth at the bottom of the pay scale actually

outpaced growth at the top for a few years. Employers were desperate to hire front-line workers, so they

offered big boosts to starting pay. But more recent data suggests that this low-wage wage boom is slowing,

while higher-paid workers are seeing more steady gains again.

2. Where You Live

Your ZIP code might be the single biggest factor in whether your pay feels “enough.”

Some regions of the U.S. have experienced much higher inflation than others, particularly in housing costs.

In areas where rents and home prices exploded, even a decent raise can feel like it vanished into your landlord’s pocket.

Studies of paycheck-to-paycheck living show that households in certain higher-cost metrosespecially in

parts of the Northeast and Midwestare more likely to spend nearly all their income on necessities.

Meanwhile, some households in relatively affordable parts of the South and West have had a little more

breathing room as wages rose and local prices stayed (for a time) more contained.

3. Your Willingness to Switch Jobs or Negotiate

This one might sting: workers who stay put often see slower wage growth than those who switch jobs.

Surveys consistently find that people who change employers are more likely to report pay increases that

beat inflation, while those who stay with the same company year after year tend to lag behind.

That doesn’t mean you should quit on a whim, but it does mean that job mobility and

negotiation matter. Asking for a raise, seeking a promotion, upskilling into higher-paid

roles, or being open to a new employer can significantly change whether your pay beats inflation over time.

What If Your Pay Isn’t Keeping Up?

If you’re in the large group of people whose pay hasn’t kept pace with prices, you’re not “bad with money”

and you’re not alone. You’re living in an economy that’s been unusually tough on household budgets.

You can’t personally fix inflation, but you can control your response. A few practical moves:

-

Know your numbers. Track your real spending and income year over year. Seeing how

much your costs have risen can give you a stronger case when asking for a raise or considering a job change. -

Benchmark your pay. Use salary tools, job boards, and industry reports to figure out

whether your current pay is below market. If it is, you have data to back up a raise requestor to justify

applying elsewhere. -

Focus on high-impact expenses. Housing, transportation, and food often eat the biggest

chunks of a budget. Even modest changes in these categorieslike a roommate, a cheaper commute, or more

home-cooked mealscan free up room when raises fall short. -

Invest in your skills. Over time, building in-demand skills is one of the most reliable

ways to outpace inflation. Certifications, technical training, and experience in high-growth fields can

produce pay boosts that compound for years.

None of this is as satisfying as someone dropping a 20% raise in your lap, but in a world where prices don’t

wait for your paycheck to catch up, active career management is increasingly non-optional.

If Your Pay Rose Faster Than Prices, You’re LuckyNow Use It Well

Let’s say you’re one of the fortunate workers whose pay has consistently beaten inflation

over the past year or two. Maybe you negotiated a strong raise, landed a higher-paying job, or work in a sector

that’s still in high demand. What you do next matters a lot.

When your real income rises, it can be tempting to immediately upgrade everythingbigger apartment, nicer car,

fancier vacations. A little lifestyle upgrade is fine; you’ve earned the right to enjoy your progress. But if you

want this lucky streak to translate into long-term security (not just nicer takeout), consider a different approach:

-

Build or reinforce your emergency fund. Aim for at least three to six months’ worth of

essential expenses. That cushion turns job loss, medical bills, or car repairs from financial disasters into

annoying inconveniences. -

Attack high-interest debt. Using extra income to pay down credit card balances or personal loans

can dramatically improve your financial position. The “return” you get from eliminating a 20% interest rate

beats most investments. -

Increase retirement contributions. If your employer offers a 401(k) match, make sure you’re at

least contributing enough to get the full match (that’s free money). Then, consider slowly increasing your

contribution rate as your pay rises. -

Invest in your future earning power. Use some of your surplus to pay for courses, tools, or

certifications that make you even more valuable in the job market. -

Leave room for joy. You don’t have to funnel every extra dollar into “responsible” categories.

Budget a reasonable amount for fun so you don’t burn out and rebel against your own plan.

The point is simple: if your pay is beating prices, you have something many people don’t right nowoptions.

Turning that temporary advantage into lasting security is where the real magic happens.

Big Picture: The Economy vs. Your Personal Reality

Economists will keep arguing over whether “wages are keeping up with inflation” in the aggregate,

using charts, indexes, and long-run averages. These debates matter for policy, interest rates,

and the overall direction of the economy.

But your reality is much more direct: Is your paycheck stretching further than it did a year or two ago?

Can you cover the essentials with less stress? Do you have more room to save, pay down debt, or plan for

the future? Those are the questions that tell you whether you’re personally winning the race against rising prices.

If the answer is yes, you’re in a fortunate minorityand with a smart plan, you can turn that luck into

long-term resilience. If the answer is no, you’re in crowded company, and the path forward may involve a mix

of careful budgeting, career moves, and patience while the broader economy slowly rebalances.

Either way, understanding the difference between nominal and real wages, paying attention to your own numbers,

and making intentional decisions about your money gives you more control in a world that often feels like

it’s raising prices just for fun.

Experiences from the Real World: What It Feels Like When Pay Finally Beats Prices

Statistics are useful, but they don’t quite capture the emotional whiplash of living through several years

of high inflation. For many people, it wasn’t just that prices went up; it was that they went up

faster than anyone’s paycheck seemed able to keep up. When your pay finally rises faster than prices,

the change is more than mathematicalit’s deeply personal.

Take Jordan, a public school teacher. For years, Jordan watched rent and groceries climb while

salary increases barely covered rising health insurance premiums. During the high-inflation years, every pay bump

felt like a mirage. But after a combination of a district-wide raise, a promotion to department head, and slightly

cooler inflation, Jordan realized something surprising: there was money left over at the end of the month.

It wasn’t a lot, but it was enough to start a small emergency fund and finally replace a dying laptop instead

of nursing it along one more semester.

Or consider Maria, a warehouse worker who stuck with her employer through chaotic pandemic shifts.

At first, the raises felt generoustwo, sometimes three bumps in a year. But as rent, gas, and food prices all

spiked, those raises evaporated on the way to the checkout line. Only in the last year, after another pay bump and

a move to a slightly cheaper neighborhood, did Maria feel like she was getting ahead. She could send a little money

back to family, pay more than the minimum on her credit card, and even budget for a modest vacation for the first

time in a decade.

Then there’s Alex, a remote software developer. On paper, Alex’s pay was beating inflation all along

raises, bonuses, equity grants, the whole package. But living in a major coastal city with extreme housing costs

meant that even a strong salary sometimes felt tight. When Alex finally relocated to a lower-cost city while keeping

the same job and pay, the effect was dramatic. The same paycheck suddenly covered a nicer apartment, higher retirement

contributions, and extra savings. For Alex, “pay beating inflation” became real only when combined with a big lifestyle

and location change.

Finally, imagine Taylor, a single parent working in health care. Taylor went back to school part-time

to move from an assistant role into a licensed position. For a few years, it meant juggling classes, long shifts, and

tight budgets while inflation was surging. But once the new license kicked in, Taylor’s pay jumped significantly.

Even though prices were still elevated, the new salary outpaced them enough to change day-to-day lifeless anxiety

about unexpected bills, the ability to sign the kids up for activities, and the relief of not having to choose

between paying down debt and buying decent groceries.

These stories have a common thread: the moment when pay finally beats prices feels like a weight lifting.

It doesn’t mean everything is perfectsurprises still happen, and the future is never guaranteedbut it does mean

your financial life moves from pure survival to cautious growth. That transition is exactly why people who see their

income outpace inflation are, in a very real sense, lucky.

Luck, though, is only part of it. Each of these people also made choices: staying in the labor force under pressure,

pushing for credentials, moving, negotiating, or sticking with tough jobs during chaotic times. When economic tailwinds

finally align with those efforts, the result can be life-changing.

If your pay has risen faster than prices lately, you’re standing in that rare, hopeful space. The key is to recognize it,

appreciate it, and use it intentionallyso that when the next economic shock inevitably shows up, you’re not starting

from zero all over again.