Table of Contents >> Show >> Hide

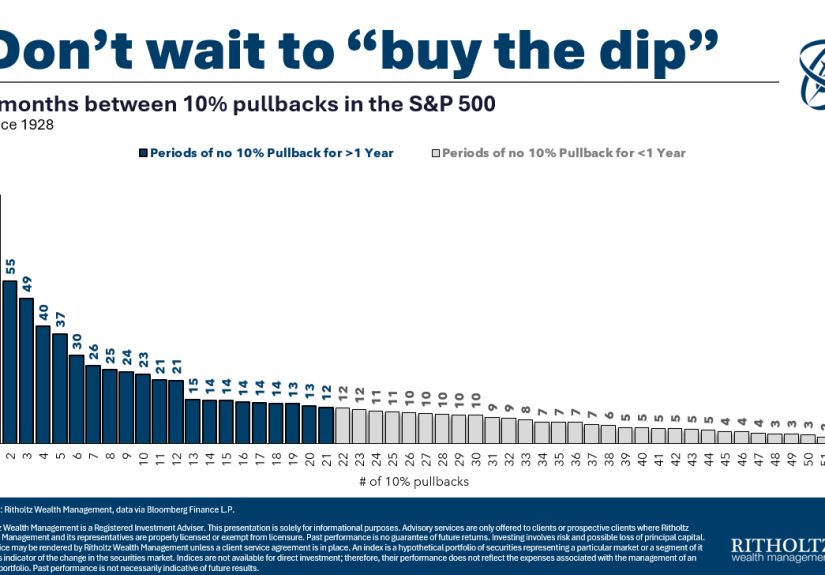

Investing is a game of strategies, and one popular phrase that’s often thrown around is “buy the dip.” Whether you’re new to the world of finance or a seasoned investor, the idea of purchasing assets when their prices fall can sound appealing. After all, buying at a low price seems like a foolproof way to profit when the prices inevitably rebound. But does “buy the dip” really work in practice, or is it just a myth we all hope to believe? In this article, we’ll explore the pros and cons of this strategy, examine whether it has worked historically, and evaluate its effectiveness in different market conditions.

What Does “Buy the Dip” Mean?

At its core, “buy the dip” refers to purchasing stocks, bonds, or other assets when their prices experience a temporary decline. The theory behind this strategy is that these drops are often short-lived, and the value of the asset will rebound after the correction. Investors see this as an opportunity to buy at a lower price, anticipating that the asset will return to, or surpass, its previous highs over time.

Understanding Market Cycles

Before diving into whether “buying the dip” works, it’s important to understand the nature of market cycles. Financial markets are often characterized by periods of growth (bull markets) followed by declines (bear markets). A bull market is when prices are generally on the rise, and a bear market is when prices are falling.

Market cycles can be influenced by a variety of factors such as economic conditions, interest rates, geopolitical events, and investor sentiment. While dips may represent temporary corrections within a broader bull market, they can also be signals of longer-term downtrends. Hence, the timing of a dip can be crucial to determining whether buying it will yield profits or losses.

Historical Success of “Buying the Dip”

Historically, “buy the dip” has worked well during periods of strong, sustained growth. For instance, during the post-2008 recovery, investors who bought the dip in stocks such as Apple or Tesla saw significant returns as these companies grew rapidly in the following years. The same can be said for the COVID-19 crash in March 2020, where the market experienced a sharp dip, but recovery was swift, and many stocks quickly regained and exceeded their pre-pandemic levels.

However, it’s important to remember that not all dips are equal. Some dips may represent temporary corrections, while others might signal a deeper, longer-term downtrend. In situations where the dip occurs during a bear market or as a result of broader systemic issues, the rebound may take much longer or may never fully materialize.

The Risks of “Buying the Dip”

While the “buy the dip” strategy can yield substantial returns, it’s not without risks. A major concern is timing. Investing during a market decline requires the ability to differentiate between a temporary dip and the start of a bear market. If you purchase an asset that continues to fall, you may face significant losses. Moreover, there’s always the possibility that a stock or sector may never fully recover.

Another key risk is that dips can often be caused by underlying weaknesses in the economy or company fundamentals. For example, if a company’s stock is dipping due to poor earnings, ineffective leadership, or declining market share, buying the dip might be a costly mistake. If the issues causing the dip aren’t temporary, you could find yourself holding an asset that continues to lose value.

Timing the Market: An Impossible Task?

One of the biggest debates in investing is whether it’s possible to time the market successfully. Buying the dip requires you to predict when prices have hit their lowest point and when they will start to rebound. The problem is that even seasoned investors often struggle with timing market movements accurately. Financial markets are complex and influenced by a myriad of unpredictable factors, making it almost impossible to time a market dip perfectly.

As the saying goes, “It’s not about timing the market, but time in the market.” Long-term investors who focus on holding assets through market cycles often fare better than those who attempt to buy the dip consistently. This is why index funds and diversified portfolios are often considered safer and more reliable in the long run compared to speculative stock picking.

Does Buy the Dip Work in All Market Conditions?

Whether “buying the dip” works depends largely on the broader market conditions. During periods of economic growth and expansion, buying the dip can be a rewarding strategy. Stocks tend to recover from short-term declines, and the overall market direction is upwards. However, in prolonged bear markets or during financial crises, buying the dip may lead to extended losses as asset prices continue to decline.

For instance, during the dot-com bubble burst in the early 2000s, many investors bought the dip in tech stocks, expecting a quick rebound. Unfortunately, these stocks did not recover quickly, and it took years for many tech companies to regain their previous heights. In contrast, during the 2013-2018 bull market, buying the dip in the broader stock market would have resulted in significant profits.

Key Takeaways: When Does It Work Best?

The “buy the dip” strategy works best in the following conditions:

- During a strong bull market: When overall market conditions are positive and asset prices tend to rise over time.

- For companies with strong fundamentals: If a company is temporarily undervalued due to short-term factors, it may offer a solid buying opportunity.

- When diversifying a portfolio: Buying the dip in a well-diversified portfolio can help smooth out volatility over the long term.

Conclusion

In summary, “buying the dip” can be an effective investment strategy in the right market conditions, especially during bull markets or for companies with strong fundamentals. However, it’s important to approach this strategy with caution. Market timing is incredibly difficult, and not all dips will result in a quick rebound. Understanding the underlying reasons for a dip and evaluating whether the asset will recover are crucial for successful investing. For many investors, a more diversified, long-term approach to investing may provide more consistent and less risky returns than relying on the hope that prices will bounce back after every dip.

As always, remember to do your research, consult with financial experts, and ensure that your investment strategy aligns with your long-term goals and risk tolerance.

Experience Related to “Does Buy the Dip Work?”

In my experience, the concept of buying the dip can be incredibly rewarding, but it requires discipline and patience. During the early days of the COVID-19 pandemic, I watched many investors panic as stock prices plummeted. At that time, I took the opportunity to purchase stocks that had long-term potential but were temporarily undervalued due to the market panic. By mid-2020, the market had rebounded, and many of my investments had grown significantly. However, I also witnessed some friends invest in stocks that were dipping due to poor fundamentals, and those investments didn’t fare as well.

Ultimately, the experience taught me that while buying the dip can be effective, it’s vital to differentiate between a temporary correction and a deeper structural issue within the market or specific companies. Blindly buying the dip without a strategic approach can lead to poor decisions, but with the right research and analysis, this strategy can be an excellent way to capitalize on market volatility.