Table of Contents >> Show >> Hide

- What “cash value” actually is

- Where the value comes from (and where it leaks out)

- Value source #1: Lifelong coverage and forced consistency

- Value source #2: Tax treatment (helpful, but not magic)

- Value leak #1: The cost of “doing two jobs”

- Value leak #2: Surrender charges and the “commitment curve”

- Value leak #3: Policy loan interest and lapse risk

- Value leak #4: Complexity (especially with variable and indexed designs)

- How to judge “valuable”: a practical scorecard

- Common ways people use cash value (smartly and not-so-smartly)

- Specific examples: when cash value can (and can’t) shine

- The fine print that matters most

- So… how valuable is cash value life insurance, really?

- Real-World Experiences: What Policyholders Often Notice

- Experience #1: “Year one looked… underwhelming.”

- Experience #2: “I loved the stability… until I compared opportunity costs.”

- Experience #3: “Policy loans were helpful, but they came with homework.”

- Experience #4: “The policy did exactly what it was designed to do… and that wasn’t what I needed anymore.”

- Experience #5: “The best purchase moments were calm. The worst were rushed.”

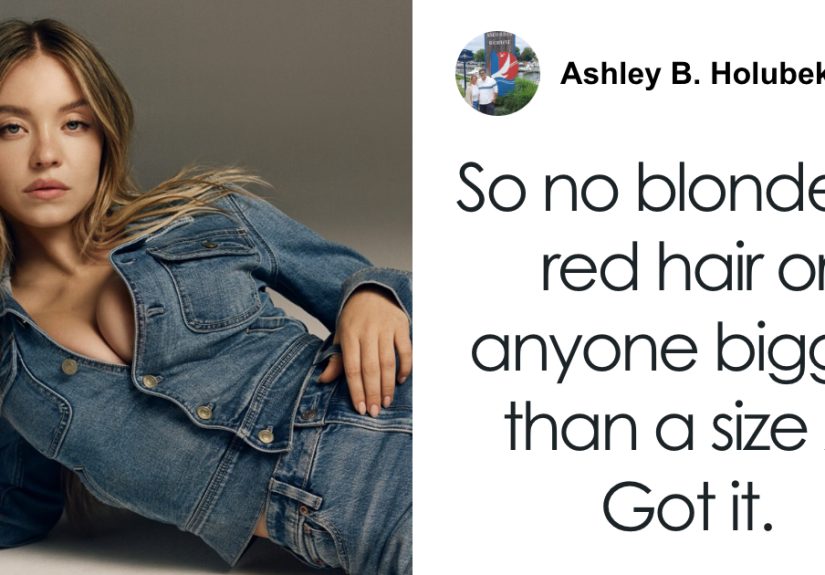

Cash value life insurance is the financial equivalent of a Swiss Army knife: part protection, part savings, part “please don’t cancel me in year three.”

Some people swear it’s underrated. Others swear it’s overpriced. The truth (annoyingly) is: it can be genuinely valuableor it can be an expensive way to

learn what “surrender charge” means.

This guide breaks down what cash value is, where the value comes from (and where it leaks out), how to evaluate it like a grown-up, and what real-life

policyholders often experience once the honeymoon period ends and the annual statements start showing up.

What “cash value” actually is

Cash value is the money that builds inside certain permanent life insurance policies (not term). When you pay premiums, part of your

payment goes to the cost of insurance and policy expenses, and part may build an internal account value. Over time, that account value can growsometimes

with guarantees, sometimes with market-linked features, and sometimes with enough fine print to qualify as a light workout.

Which policies usually have cash value?

- Whole life insurance: Generally offers a level premium, a guaranteed death benefit, and a cash value schedule with guarantees. Some policies may also pay dividends (not guaranteed).

- Universal life (UL): More flexible premiums and death benefit options; cash value typically earns interest based on a declared rate or formula.

- Variable life / variable universal life (VUL): Cash value is invested in sub-accounts (similar to mutual-fund-like options). Returns can be higheror lowerbecause you take investment risk.

- Indexed universal life (IUL): Cash value growth is tied to a market index formula (with caps, participation rates, spreads, and other “sounds-simple-until-it’s-not” mechanics).

In short: cash value is not “extra free money.” It’s a feature you fund over time, with tradeoffs.

Where the value comes from (and where it leaks out)

Value source #1: Lifelong coverage and forced consistency

If you need life insurance for your entire lifetime (not just while kids are young or the mortgage is big), permanent coverage can be appealing.

Cash value policies also “force” some people to save because premiums are due whether motivation is high or your favorite streaming service just raised prices again.

Value source #2: Tax treatment (helpful, but not magic)

Cash value typically grows tax-deferred inside the policy. The death benefit is generally paid to beneficiaries income-tax-free.

Accessing cash value can sometimes be done in tax-advantaged waysoften through policy loansif the policy stays in force and is structured properly.

The tax rules have important guardrails. For example, if a policy becomes a Modified Endowment Contract (MEC), loans and withdrawals can be taxed differently

(often less favorably) and may trigger penalties if you’re under 59½. Translation: the IRS is happy to let you use life insurancebut not as an unlimited tax-free piggy bank.

Value leak #1: The cost of “doing two jobs”

Cash value life insurance tries to do two jobs: insurance + cash accumulation. That usually means higher premiums than term life.

In many cases, the early years are cost-heavy because of policy charges and compensation structures. The cash value may build slowly at first, and surrendering early

can be financially painful.

Value leak #2: Surrender charges and the “commitment curve”

Many permanent policies include surrender chargesespecially in the early yearsdesigned to discourage short-term ownership. This is one reason cash value life insurance

is usually discussed as a long-term strategy, not a “try it for a year and see how it feels” purchase (like a gym membership, but with more paperwork).

Value leak #3: Policy loan interest and lapse risk

Borrowing against cash value can be useful, but it isn’t free. Loans typically accrue interest. If loans and interest grow too large relative to cash value,

the policy can implode (a technical term meaning “lapse”), and that can create nasty tax consequencesespecially if your outstanding loan exceeds your cost basis.

Value leak #4: Complexity (especially with variable and indexed designs)

With variable life/VUL, you take market risk and face layers of fees (policy charges plus investment-related costs). With indexed designs, returns may be limited by caps,

participation rates, and spreads. These can still work well for the right buyerbut they reward people who read policy illustrations carefully and ask

“What happens if returns are mediocre for 10 years?” without flinching.

How to judge “valuable”: a practical scorecard

Instead of asking, “Is cash value life insurance good?” try asking, “Is it good for my specific job-to-be-done?” Here’s a quick scorecard:

Cash value life insurance tends to be more valuable if you:

- Need insurance that could last your entire life (estate liquidity, lifelong dependent, business planning, or legacy goals).

- Have a long time horizon (often 10–15+ years) and can keep funding the policy.

- Have already maxed out other tax-advantaged options (like employer retirement plans, IRAs, HSAs, where applicable) and want additional tax-deferred accumulation.

- Value stability and guarantees (especially with certain whole life designs), even if growth is more “slow and steady” than “to the moon.”

- Want access to liquidity options (loans/withdrawals) and understand the rules and tradeoffs.

It tends to be less valuable if you:

- Primarily need inexpensive coverage for a specific period (income replacement while raising kids, mortgage protection).

- Don’t have reliable cash flow to keep premiums consistent.

- Think you might cancel within the first several years (surrender charges can bite).

- Prefer straightforward investing and don’t want policy mechanics, illustrations, and loan strategies as a recurring hobby.

- Are being sold a story that sounds like “high returns, no risk, tax-free forever, and also a pony.”

Common ways people use cash value (smartly and not-so-smartly)

1) Policy loans for flexibility

Many policies allow you to borrow against cash value. This can be helpful for temporary cash needsemergency expenses, bridging a short-term gap, or

opportunities where you’d rather not sell investments at a bad time.

The not-so-fun part: loan interest accrues, and unpaid loans reduce the death benefit. If the policy lapses with an outstanding loan, taxes can become a problem.

A “loan strategy” should always include a “loan repayment or containment strategy.”

2) Withdrawals and partial surrenders

Some policies let you withdraw cash value. Generally, withdrawals above your cost basis may be taxable, and withdrawals can reduce cash value and/or the death benefit.

Permanent insurance is not a checking accountit’s closer to a long-term financial tool with rules and consequences.

3) Using cash value to help pay premiums

Some policyholders eventually use dividends (if available) or accumulated cash value to offset premiums. This can reduce out-of-pocket costs later, but it depends on

policy performance, funding levels, and how the policy is structured.

Specific examples: when cash value can (and can’t) shine

Example A: Lifetime need + estate liquidity

Maya, 62, expects her family to inherit an illiquid asset (a family property). She worries heirs might need cash to handle taxes, equalize inheritances, or maintain the property.

A permanent policy can create a pool of liquidity at death. In this use case, the “value” is less about beating the stock market and more about delivering

a predictable outcome when it matters.

Example B: High-income saver who already maxes other options

Devon, 45, consistently maxes retirement contributions and keeps an adequate emergency fund. He wants another bucket that can grow tax-deferred and potentially provide

flexible access later. A carefully designed permanent policy might fitbut only if he understands costs, time horizon, and the possibility that returns are modest,

especially early on.

Example C: “I want an emergency fund that won’t judge me”

Lina, 38, likes the idea of building a source of liquidity she can borrow against. Cash value can support that goal, but it’s usually a poor substitute for

a basic emergency fund in the early years (because cash value may be low and surrender charges may apply).

A more realistic approach is: build a normal emergency fund first, then consider cash value for longer-term flexibility.

Example D: The term-and-invest alternative

Chris, 33, needs a large amount of coverage at the lowest cost while his kids are young. Term life gives him more death benefit per premium dollar.

If he invests the premium difference consistently, he may build significant assetswithout surrender charges or policy mechanics.

In this case, cash value insurance might be “valuable” only if Chris has a lifelong insurance need or values guarantees enough to justify the higher premium.

The fine print that matters most

1) Is it a MEC (or could it become one)?

Funding a policy aggressively can push it into Modified Endowment Contract territory. MECs can still be useful, but the tax treatment of loans and withdrawals changes.

If “tax-advantaged access” is part of the plan, MEC rules are not optional reading.

2) What do the surrender charges look like?

Ask for the surrender charge schedule and consider your likelihood of keeping the policy long enough to get past the steep part of the curve.

If you might cancel in 3–7 years, treat that as a bright red flag.

3) What assumptions are driving the illustration?

Policy illustrations often show “guaranteed” and “non-guaranteed” values. The gap between them matters.

For indexed and variable designs, ask how the policy behaves under lower returns, higher costs of insurance, or long flat markets.

4) What are the ongoing policy charges?

Every permanent policy has costs (some more visible than others): cost of insurance, administrative charges, premium loads, rider costs, and potentially investment-related fees.

Understanding these is essential to understanding value.

So… how valuable is cash value life insurance, really?

Cash value life insurance is valuable when it solves a specific problem better than alternatives:

lifelong coverage needs, predictable legacy goals, disciplined long-term saving with certain guarantees, or additional tax-deferred accumulation for people who have already

optimized other financial priorities.

It’s less valuable when it’s used as a one-size-fits-all “investment,” when the buyer can’t commit long-term, or when expectations are set by marketing slogans

instead of realistic illustrations and clear math.

Bottom line: The “value” of cash value life insurance isn’t a single number. It’s the combination of protection, time horizon, costs, guarantees,

tax rules, and your ability to stick with the plan. If you evaluate it like a long-term tool (not a short-term hack), you’ll make a much better decision.

Friendly reminder: This article is educational and not financial, legal, or tax advice. For personal recommendations, consider a licensed insurance professional

and a qualified tax or financial advisor who can review your goals and your actual illustrations.

Real-World Experiences: What Policyholders Often Notice

If you ask a roomful of policyholders how cash value life insurance feels in real life, you’ll rarely get a calm, neutral shrug. You’ll get stories.

The stories varybut they tend to rhyme. Here are common experiences people report, based on recurring themes in consumer guides, advisor discussions,

and the way these products are designed to behave over time.

Experience #1: “Year one looked… underwhelming.”

Many first-time policyholders expect the cash value to build quickly, because “I’m paying a lot, therefore my account should be a lot.”

But early policy years can feel slow. Charges are often front-loaded, and it can take time for the policy’s internal value to catch up with the total premiums paid.

People who understood the long horizon beforehand are usually fine. People who thought it would behave like a high-yield savings account are usually not.

The lesson they share: if you might need to access most of the money in the first few years, you probably wanted a different tool.

Experience #2: “I loved the stability… until I compared opportunity costs.”

Some policyholders appreciate the predictability of guaranteed values (where available) and the fact that cash value isn’t directly whipsawed by daily market volatility.

That emotional comfort can be real value. But others later compare what they paid in premiums to what they might have built by buying term and investing the difference.

They don’t always regret the policyespecially if lifelong coverage was a prioritybut they do wish they had compared scenarios side-by-side before buying.

A common takeaway: the most honest comparison includes both goalsinsurance need and wealth-building needwithout pretending one product must win both contests.

Experience #3: “Policy loans were helpful, but they came with homework.”

People who use loans successfully often describe them as a flexible option: they borrowed during a cash crunch, then repaid over time.

The ones who struggle usually borrowed repeatedly without a repayment plan, letting interest snowball.

They may notice their cash value growth slowing, their net death benefit shrinking, or anxiety rising when they realize a lapse could trigger taxes.

Their advice to new buyers is blunt: treat policy loans like a real loan, because it is. Borrow intentionally, track it, and plan your exit.

Experience #4: “The policy did exactly what it was designed to do… and that wasn’t what I needed anymore.”

Life changes. A policy bought for “family protection” can become less relevant after kids are financially independent.

A policy bought for “tax strategy” can feel unnecessary if income drops or priorities change. Some policyholders adjust coverage, reduce funding, or keep the policy for legacy reasons.

Others surrender and move onsometimes happily, sometimes with a wince after seeing surrender values.

The repeating theme is not that the product is “bad,” but that long-term products punish short-term ownership. People who keep the policy long enough often feel it becomes

more useful with time; people who exit early often feel like the policy was built for someone with a different timeline.

Experience #5: “The best purchase moments were calm. The worst were rushed.”

Many policyholders say the best outcomes happened when they bought after careful planning: they understood the illustration, knew their time horizon, had stable cash flow,

and had a clear reason for permanent coverage. The worst outcomes happened when the purchase was rushed, sold as a “can’t lose” investment,

or bought before basic financial priorities (like emergency savings and high-interest debt payoff) were handled.

The practical lesson: cash value life insurance is a planning tool, not a panic button. If the pitch feels like urgency, it’s worth slowing down.

Put together, these experiences point to a simple truth: cash value life insurance can be valuablebut it rewards clarity, patience, and realistic expectations.

If you “select and insure” with your eyes open (timeline, costs, loan rules, and all), you’re far more likely to end up with a policy that feels like a feature,

not a financial regret.