Table of Contents >> Show >> Hide

- A quick snapshot: the four main ways to send money

- How to compare money transfer options (the math that actually matters)

- Popular ways to send money to Tonga from the U.S. (and what they’re good at)

- Step-by-step: how to send money to Tonga without headaches

- What your recipient in Tonga may need (so pickup day goes smoothly)

- Timing realities: why “tomorrow” can mean different things in Tonga

- Consumer protections and cancellation: what U.S. senders should know

- How to avoid scams (because scammers love “urgent”)

- Troubleshooting: common issues and quick fixes

- FAQs: quick answers for common “send money to Tonga” questions

- Real-world experiences: what it’s actually like to send money to Tonga from the U.S. (500-word add-on)

- Conclusion: the simplest way to send money to Tonga from the U.S.

Sending money to Tonga from the U.S. sounds like it should be as easy as sending a text. In reality, it’s more like

ordering takeout: the menu is huge, the “delivery time” depends on where it’s going, and the final price can change

once exchange rates and fees get involved. The good news? Once you know what to compare, you can get funds to family

in Tonga quickly, safely, and without paying “mystery-fee roulette.”

This guide breaks down the most common transfer methodscash pickup, bank deposit, mobile wallet, and international

wireplus how to choose a provider, reduce costs, avoid scams, and handle the small details that make the difference

between “smooth transfer” and “why is Auntie texting me at 2 a.m.?”

A quick snapshot: the four main ways to send money

1) Cash pickup (fastest for many families)

Cash pickup is often the simplest for recipients who prefer cash or don’t have easy access to online banking. You

send money through a provider, your recipient visits a local agent, shows ID, and picks up the cash (usually in TOP

or sometimes in another available currency, depending on the provider and location).

- Best for: emergencies, quick help, recipients without bank accounts

- Watch-outs: recipient name must match ID; agent hours and availability matter

2) Bank deposit (neat, trackable, and usually safer)

Bank deposits send money directly to a Tongan bank account. This can be more convenient for bills, school fees, or

relatives who don’t want to travel to an agent location.

- Best for: regular support, larger planned transfers, recipients with bank accounts

- Watch-outs: you need correct bank/account details; timelines can be slower

3) Mobile wallet (when “pickup” means “tap”)

Some providers let you send to a mobile wallet in Tonga. If your recipient uses a supported wallet, money can arrive

quickly and can be used for local payments or cash-out (depending on the wallet’s features).

- Best for: fast delivery without travel, tech-comfy recipients

- Watch-outs: wallet must be active and supported; phone number formatting must be correct

4) International wire (for “serious business” transfers)

Wire transfers move funds through banks (SWIFT). They’re common for large amounts, official payments, or when you

want money delivered in a specific currency (often USD to a USD-denominated account, if available). Some services

specialize in bank-to-bank transfers with competitive rates, but wires can involve bank and intermediary fees.

- Best for: large transfers, formal payments, bank-to-bank reliability

- Watch-outs: intermediary fees; slower delivery; more details required

How to compare money transfer options (the math that actually matters)

Look at the “total cost,” not just the fee

Most people compare the transfer fee and call it a day. That’s like buying a plane ticket and ignoring baggage

fees, seat fees, and the “I breathed air on the plane” fee. The real cost is usually:

Total cost = transfer fee + exchange rate markup + any third-party fees

Two providers can both charge a $2.99 fee, but if one gives a worse USD-to-TOP rate, your recipient may receive less

by the time the money lands in Tonga.

Speed and price are usually trading places

Faster transfers often cost more. Paying by bank transfer/ACH can be cheaper but slower, while debit card payments

can speed things up (sometimes with a higher fee). If your recipient needs the money today, you might accept a

higher cost. If it’s planned support, slower and cheaper can be the smarter move.

Delivery method is half the battle

The “best” service depends on how your recipient will receive money in Tonga. A great rate doesn’t help if the

nearest cash pickup agent is far away or the recipient doesn’t have a bank account. Start with how they want to

receive, then find the best price for that method.

Popular ways to send money to Tonga from the U.S. (and what they’re good at)

Availability can change, but these categories show the most common provider styles you’ll see when sending from the

U.S. to Tonga.

Remittance apps with multiple delivery options

Many app-based money transfer services support Tonga through networks of local partners for cash pickup,

bank deposits, and sometimes mobile wallets. For example, some services explicitly

list partner banks and payout networks in Tonga, which can help you match your recipient’s needs.

-

Cash pickup: Great for speed and simplicity. Share the reference number, make sure the recipient’s

name matches their ID, and confirm the pickup location and hours. -

Bank deposit: Great for routine transfers and bill-like payments. You’ll need accurate bank and

account details. -

Mobile wallet: Great if the recipient actively uses a supported wallet and wants quick access on

their phone.

Large-transfer and bank-to-bank specialists

If you’re sending a larger amount (think tuition, major repairs, or planned family support), bank-to-bank services

can be a strong fit. They often emphasize competitive exchange rates and transparent feesbut remember that wires can

involve intermediary banks that may deduct fees along the way.

Traditional agent networks (still very relevant)

Agent-based networks remain popular because they offer a straightforward “walk in, pick up cash” experience, which

matches real-world needs in many communities. They can be especially useful if your recipient doesn’t use online

bankingor if you’re helping someone who just wants the money in hand, today.

Step-by-step: how to send money to Tonga without headaches

-

Ask your recipient how they want to receive it.

Cash pickup, bank deposit, or mobile wallet? Also ask what’s easiest geographicallyTongatapu vs. outer islands

can change which pickup locations are practical. -

Collect the right details.

- Cash pickup: recipient’s full legal name (exactly as on ID), phone number, and location preference

- Bank deposit: bank name, account name, account number, and any required identifiers

- Mobile wallet: wallet provider (if applicable) and the correct phone number format

-

Compare offers using the same send amount and delivery method.

Compare the total cost and the amount your recipient will receive. Don’t mix apples and oranges (e.g.,

comparing a bank deposit quote to a cash pickup quote). -

Choose your payment method wisely.

Paying from a bank account can reduce cost, but a debit card may speed up funding. Credit cards can be convenient,

but some issuers treat money transfers like cash advances (translation: extra fees and interest). -

Verify your identity (yes, it’s annoying; yes, it’s normal).

Most legitimate providers require identity verification. This is part of anti-fraud and anti-money-laundering

protections. Do it once, and future transfers are usually easier. -

Send, then share the tracking/reference number immediately.

For cash pickup, the reference number and a matching name are everything. For bank deposits and wallets, confirm

the final details and keep the receipt or confirmation screen.

What your recipient in Tonga may need (so pickup day goes smoothly)

For cash pickup

- Government-issued photo ID (and the name must match what you entered)

- The transfer reference number

- Awareness of agent hours (Tonga time is far ahead of U.S. time zones)

For bank deposit

- Their bank account details must be correct and current

- They may need to check their balance or wait for bank processing

For mobile wallet

- The wallet must be active and able to receive transfers

- Phone numbers must be entered correctly (country code matters)

Timing realities: why “tomorrow” can mean different things in Tonga

Tonga sits on the other side of the calendar from the U.S. Depending on where you are in America, Tonga can be

almost a day ahead. That matters because:

- Bank transfers may only process on business days in Tonga

- Cash pickup depends on local agent hours

- A “Friday evening send” from the U.S. might land on a weekend in Tonga

If timing is critical (medical bills, urgent travel, last-minute school fees), choose a method known for speed (cash

pickup or mobile wallet where available), and send earlier in the U.S. day to align with Tonga’s business hours.

Consumer protections and cancellation: what U.S. senders should know

U.S. remittance transfers generally come with rules requiring clear disclosuresfees, exchange rate, the amount the

recipient will get, and when funds will be available. In many cases, you may also have a short window to cancel after

paying, as long as the money hasn’t been picked up or deposited yet.

Translation: reputable providers should tell you the cost before you hit send, and you should keep your

receipt/confirmation in case you need help later.

How to avoid scams (because scammers love “urgent”)

Money transfer scams often sound like emergencies: a “relative” stranded, a “government agent” demanding payment, or

a “prize” you didn’t enter. If someone pressures you to send money immediatelyespecially via wire, cash pickup, or

gift cardstreat it as a flashing red sign with a siren.

- Only send money to people you personally know and trust.

- Confirm details on a second channel. If you got a request by text, call a known number.

- Never send money to “verify” an account, unlock a prize, or pay a fake fee.

- Be skeptical of urgent secrecy. “Don’t tell anyone” is a scammer’s favorite sentence.

Troubleshooting: common issues and quick fixes

“They can’t pick it up.”

- Name mismatch: Update the recipient name to match their ID exactly.

- Wrong location: The transfer may be routed to specific partner agents.

- ID requirements: Some pickups require additional details or verification.

“The bank deposit didn’t arrive yet.”

- Processing time: Bank deposits can take longer than cash pickup.

- Incorrect account details: Even one digit off can delay or fail delivery.

- Intermediary deductions: Some bank routes may deduct fees in transit.

“The mobile wallet transfer failed.”

- Wallet not supported: Confirm the wallet provider is eligible for Tonga payouts.

- Phone number format: Country code and number formatting must be correct.

- Wallet inactive: Recipient may need to activate or verify their wallet first.

FAQs: quick answers for common “send money to Tonga” questions

Can I send Tongan paʻanga (TOP) directly from the U.S.?

Sometimes you can send funds that arrive as TOP, but not every provider supports sending TOP from the U.S. Some

services may send USD via wire instead, depending on the route. Always check what currency your recipient will get

before confirming.

What’s the cheapest way to send money to Tonga?

“Cheapest” depends on the amount, speed, and delivery method. Bank-funded transfers can be cheaper than card-funded

transfers, and bank deposits can be less expensive than instant cash pickup. Compare using the same amount and

delivery method to get a true apples-to-apples answer.

Is there a limit to how much I can send?

Limits vary by provider, payment method, and your verification level. Larger transfers may require additional

verification. If you’re sending a high amount, consider a provider designed for bank-to-bank transfers.

Will my recipient pay fees in Tonga?

It depends on the method. Cash pickup typically doesn’t charge the recipient at pickup (fees are usually priced into

the send side), while bank transfers may involve receiving bank fees depending on the bank and route.

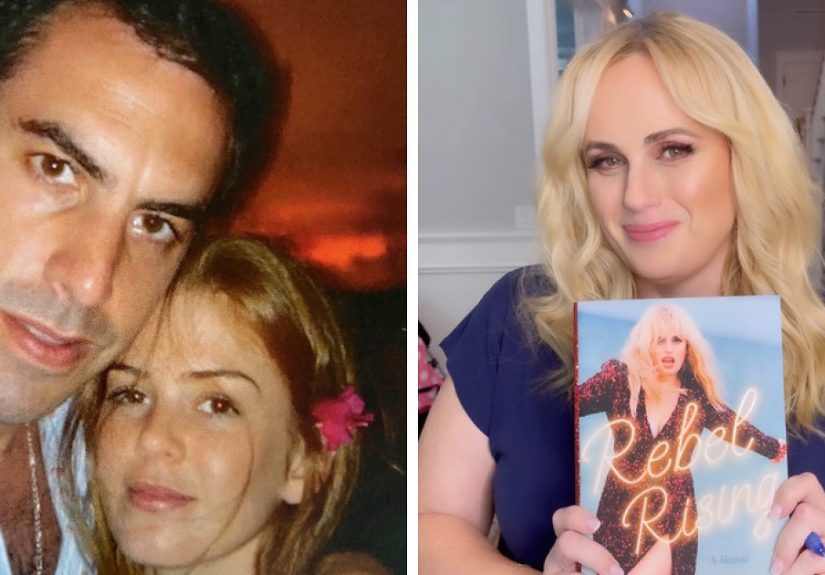

Real-world experiences: what it’s actually like to send money to Tonga from the U.S. (500-word add-on)

If you’ve ever sent money home (or to family across oceans), you already know the transfer itself is only half the

story. The other half is life happeningschool fees, birthdays, church events, surprise repairs, and the kind of

“small emergencies” that don’t feel small when you’re 6,000+ miles away.

One common experience is the “calendar trap.” A sender in California presses send on a Friday night, feeling proud

and productiveonly to realize that in Tonga it’s already Saturday afternoon. If the transfer is a bank deposit, the

money may not post until local banking resumes. That’s why many families end up using cash pickup or mobile wallet

options for anything urgent. It’s not that bank deposits are bad; it’s just that weekends and time zones have

absolutely no respect for your good intentions.

Another real-life lesson: names matter. A lot of “my family can’t pick it up” problems come down to

one thingsomeone typed “Sione” when the ID says “Sione Maile.” Or a middle name got dropped. Or a married name changed

and nobody updated the plan. In practice, families often develop a routine: the sender asks for a photo of the ID

once (stored securely, not passed around), copies the name exactly, and uses the same saved recipient profile every

time. Boring? Yes. Effective? Also yes.

People also learn quickly that the lowest fee isn’t always the best deal. Imagine sending $200 for

groceries and household basics. Provider A charges a tiny fee but offers a weaker exchange rate, so the recipient

gets less TOP. Provider B charges a slightly higher fee but gives a better rate, and the recipient ends up with more

in hand. After a few transfers, most senders stop asking “What’s the fee?” and start asking “How much will they

actually receive?”

There’s also the “location reality.” A cash pickup option might be perfect in Nukuʻalofa, but not as convenient for

someone farther out. Families often choose different delivery methods for different relatives: a bank deposit for a

parent who’s comfortable with banking, cash pickup for an uncle who prefers cash, and a mobile wallet for a cousin

who’s always on their phone and likes instant access.

Finally, there’s the emotional side: sending money is often tied to showing up when you can’t be there in person.

It’s help with school supplies, support after a storm, or making sure a loved one can handle a bill without stress.

The smoothest senders aren’t necessarily the most “finance savvy”they’re the ones with a simple checklist: confirm

the receive method, verify the name details, compare the total cost, and send early enough that Tonga’s clocks aren’t

working against them. It’s practical care, delivered in TOP.

Conclusion: the simplest way to send money to Tonga from the U.S.

The “best” way to send money to Tonga from the U.S. comes down to three questions: How does your recipient want to

receive it (cash, bank, or wallet)? How fast do they need it? And what’s the total cost once fees and exchange rates

are included? If you match the delivery method to the personand compare based on what they’ll actually receiveyou’ll

avoid most headaches and keep more value in your family’s hands.