Table of Contents >> Show >> Hide

- How Annual Per-Seat Became the Default in SaaS

- What Changed: AI, SaaS Sprawl, and Smarter Buyers

- Why the Annual Per-Seat Contract Isn’t the Gold Standard Anymore

- What’s Replacing the Old Gold Standard?

- When the Annual Per-Seat SaaS Contract Still Works

- How to Evolve Your Pricing If You’re Currently Seat-Only

- Real-World Experiences With the Annual Per-Seat SaaS Contract

- The Real Gold Standard: Alignment, Flexibility, and Trust

For more than a decade, the annual per-seat SaaS contract has been the comfy old hoodie of B2B software pricing: a little faded, very familiar, and probably still what you reach for by default. Vendors loved the predictability. Finance teams loved the clean ARR math. Sales teams loved that big, upfront check. But the market has changed. AI is reshaping how many “seats” customers actually need, finance teams have become ruthless about SaaS bloat, and buyers now expect pricing to reflect value, not just headcount.

That’s why even SaaStr’s Jason Lemkin, long-time champion of SaaS best practices, has argued that the annual per-seat contract should no longer be treated as the unquestioned gold standard. The model isn’t dead, but it’s no longer the only grown-up at the pricing table. Today’s top SaaS companies are mixing per-seat with usage-based, product-based, and hybrid models to better align price with perceived value and to reduce friction in buying and renewals.

How Annual Per-Seat Became the Default in SaaS

To understand why the annual per-seat contract is slipping from its pedestal, it’s worth remembering how it got there in the first place.

From License + Maintenance to Subscription + Seat

Classic enterprise software was sold as a big perpetual license, followed by an annual maintenance fee. When SaaS came along, the easiest mental model to port over was: “Let’s charge a recurring subscription instead of a license and use the number of users as the anchor for price.” Early category leaders like Salesforce trained the entire market to think in terms of “$X per user per month, billed annually.”

The annual prepay, meanwhile, solved several problems at once:

- Cash flow and runway: Startups could pull a full year of cash forward and reinvest it into growth.

- Predictable revenue: Boards and investors got clean ARR metrics and better visibility.

- Customer lock-in: Getting a buyer to commit for 12 months reduced churn and created switching costs.

For a while, this made the annual per-seat contract feel like the only serious way to price and package SaaS, especially in sales, marketing, and collaboration tools where headcount growth roughly matched product value.

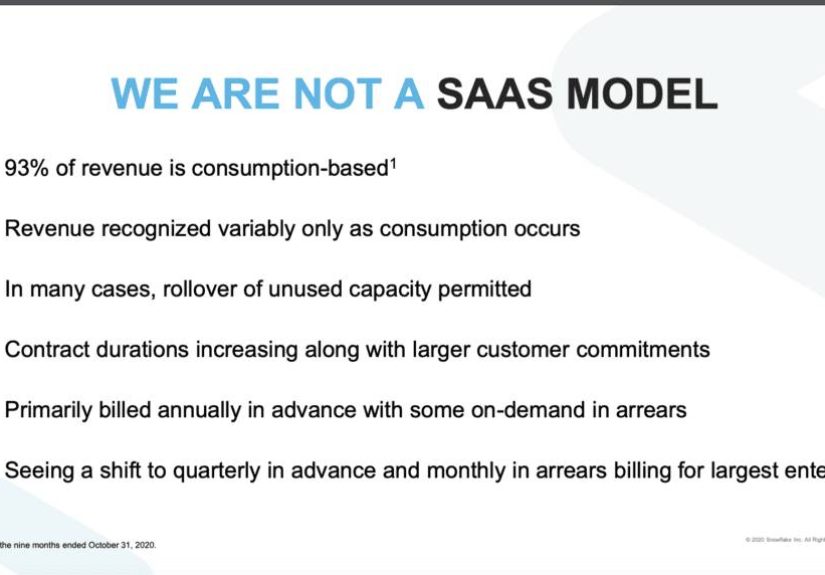

The Per-Seat Model Was Never as Dominant as People Thought

Here’s the twist: even when per-seat felt like the default, it was never truly universal. Surveys of SaaS pricing models have consistently shown that a surprisingly large share of vendors were using flat-rate, usage-based, or hybrid models rather than pure seat-based pricing. Infrastructure, developer tools, data platforms, and API-first products have always leaned more toward consumption or volume-based metrics than simple seat counts.

In other words, per-seat was culturally dominant in SaaSespecially in the sales-led, go-to-market worldbut numerically, it’s always shared the stage with other models.

What Changed: AI, SaaS Sprawl, and Smarter Buyers

If per-seat pricing was always imperfect, why is it losing elevation now? Because several powerful trends are converging at once.

AI Means “Fewer Seats, More Output”

Generative AI and automation tools have shifted the math on how many humans you actually need in a given process. If a team of 10 can now do the same work with 6 people thanks to AI-enhanced workflows, an old-school seat model suddenly looks misaligned with reality. Companies are being told they can accomplish more with each licenseand they expect pricing to reflect that.

Vendors have responded in two ways:

- Raising seat prices: Some simply increase per-seat pricing and bundle AI features into existing tiers.

- Layering usage on top of seats: Others introduce a meterAPI calls, credits, data volume, or feature usageon top of a base seat fee.

The result is that the “pure” annual per-seat model is getting rarer in modern, AI-forward SaaS products.

SaaS Inflation and Procurement Pushback

At the same time, SaaS spend per employee has climbed dramatically. Finance and procurement teams have woken up to the reality that they’re spending thousands of dollars per employee each year on softwareoften for tools used sporadically or held “just in case.” That’s pushed buyers to challenge the old assumption that every employee needs a full-price seat for every tool.

When companies audit usage, they often discover:

- Dozens of “parked” accounts for ex-employees.

- Teams with 50 licenses but only 15 active users.

- Overlapping tools with similar functionality.

Once you’ve seen that kind of waste, an annual per-seat contractespecially one paid entirely upfrontstarts to look less like a gold standard and more like a tax on inattention.

Buyers Expect Flexibility, Not Just a Discount

Modern SaaS buyers expect pricing to be:

- Transparent: Clear what they’re paying for and how costs scale.

- Value-linked: Tied to outcomes, usage, or realized value, not just headcount.

- Flexible: Able to scale up or down without punitive penalties.

An annual per-seat contract that demands 100% of the cash upfront, with limited flexibility to right-size mid-term, clashes with those expectationsespecially as more vendors offer usage-based or hybrid options that feel more “fair.”

Why the Annual Per-Seat Contract Isn’t the Gold Standard Anymore

So what exactly is broken about the old model? It’s not that it never works; it’s that the trade-offs have become more visible, and better options now exist in many categories.

Risk Is Piled Onto the Customer

A 12-month, non-cancellable, per-seat contract shifts most of the risk to the buyer:

- If usage drops, they still pay the full bill.

- If headcount shrinks, unused seats become sunk cost.

- If the product under-delivers, they’re stuck until renewal.

In a world where budgets are scrutinized quarterlyand AI is constantly changing workflowsbuyers are less willing to carry that risk. They increasingly prefer models where they can start smaller, scale with usage, or at least adjust seats more frequently without legal gymnastics.

It Can Encourage Bad Vendor Behavior

When revenue is locked in 12 months in advance purely on seats, vendors are tempted to focus on closing big upfront dealssometimes even pushing customers to overbuy seatsrather than obsessing about usable value and ongoing engagement. That can translate into:

- “Land heavy” pressure: Sales teams pushing 50 seats when the customer realistically needs 20.

- Hardball renewals: Threats to shut off access unless the customer commits early to more seats or longer terms.

- Feature bloat: Bundling AI, analytics, or add-ons into the seat price instead of clearly pricing the incremental value.

Buyers notice this. Once a vendor is perceived as “that company that shoved 80 seats down our throat,” it’s hard to rebuild trust at renewal.

It’s Misaligned With How Many Products Are Actually Used

Seat-based pricing works best when:

- The value of the product scales with number of users.

- Most users are active regularly.

- Usage across users is relatively uniform.

But lots of modern SaaS toolsAPIs, data platforms, observability, communications, even some AI copilotsdon’t follow that pattern. Usage varies wildly, value is tied to data processed or transactions rather than seats, and seat counts don’t map cleanly to business outcomes. For these products, annual per-seat pricing feels arbitrary at best and punitive at worst.

What’s Replacing the Old Gold Standard?

If the annual per-seat contract is losing its crown, what’s taking its place? The answer isn’t a single model, but a toolkit of approaches that can be mixed and matched.

Usage-Based Pricing

Usage-based pricing (UBP) charges customers based on what they actually consumeAPI calls, data volume, messages sent, minutes of video processed, and so on. It has several advantages:

- Lower barrier to entry: Customers can start small and pay as they grow.

- Value alignment: Costs scale with the value the customer receives.

- Upside for vendors: As customers get more successful, revenue expands naturally.

The downside? UBP can make forecasting and budgeting harder, and poorly designed usage meters can lead to “bill shock.” That’s why many vendors pair usage with minimums, committed spend, or guardrails to keep bills predictable.

Hybrid Models: Base Subscription + Usage + Add-Ons

The most common evolution path for seat-based products is hybrid pricing:

- A base platform fee (sometimes per org, sometimes per seat).

- Usage meters for high-cost or high-value features (AI credits, storage, transactions).

- Tiered packaging that bundles features and support levels.

This approach keeps revenue somewhat predictable while giving customers the sense that they’re paying for what they actually use. It also creates more levers for pricing experimentation and upsell.

More Flexible Contract Structures

Contract terms themselves are evolving as well:

- Quarterly true-ups: Customers can adjust seats or commitments every quarter instead of once a year.

- Drawdown models: Buyers commit to an annual or multi-year pool of spend that they draw down via seats or usage.

- Multi-year with flexibility: Longer terms but with built-in rightsizing and renegotiation windows.

These structures keep the predictability vendors love, but remove the “all risk on the customer” dynamic that made old-school annual seat contracts feel unfair.

When the Annual Per-Seat SaaS Contract Still Works

All that said, the annual per-seat model isn’t obsolete. There are plenty of places where it still shines, especially when used thoughtfully.

Great Fit: Tools With Broad, Consistent Usage

If your product is used by nearly everyone in a department or company every dayCRM for sales teams, help desk systems for support teams, collaboration tools for cross-functional workper-seat pricing is intuitive and easy to explain. In those cases, an annual per-seat contract can still be a perfectly reasonable choice, especially when paired with:

- Transparent pricing tables.

- Reasonable downgrade policies at renewal.

- Clear options to add or reassign seats during the term.

Aligning Per-Seat With Customer Value

Where vendors get in trouble is when the contract structure ignores how the customer actually gets value. If you’re going to stick with an annual per-seat model, you can de-risk it for the buyer by:

- Charging only for active users rather than provisioned accounts.

- Offering a lower per-seat price in exchange for a smaller initial seat count.

- Including a formal mid-term review to adjust seat counts based on real usage.

In other words, don’t cling to the gold standard myth. Treat the annual per-seat contract as one tool in the pricing toolbox, not the final word.

How to Evolve Your Pricing If You’re Currently Seat-Only

If your product is still sold primarily via annual per-seat contracts, you don’t need to blow everything up overnight. You can evolve incrementally.

Step 1: Get Honest About Usage and Value

Start by looking at how customers actually use your product:

- What percentage of seats are active monthly?

- Are there heavy-user and light-user segments?

- Are seats a good proxy for valueor are other metrics (projects, messages, data, API calls) more meaningful?

This analysis helps you understand where seat-based pricing is aligned and where it’s silently taxing customers for unused capacity.

Step 2: Introduce Usage or Value Metrics in a Safe Way

Instead of flipping to pure usage-based pricing, experiment at the edges:

- Add metered AI or premium features on top of existing seat tiers.

- Offer a “commit + overage” plan for power users who want more elasticity.

- Test value-based packaging with a small subset of new customers.

This lets you learn without destabilizing your core revenue.

Step 3: Rethink Contract Flexibility

You can keep annual commitments while relaxing the most painful parts for buyers:

- Allow limited downward seat adjustments at renewal.

- Offer quarterly reconciliation of seats or usage against a committed minimum.

- Create a drawdown or credit-based model for larger, multi-product deals.

When you show customers you’re willing to share risk, the conversation moves away from “How do I avoid being locked in?” and toward “How much value can we create together?”

Real-World Experiences With the Annual Per-Seat SaaS Contract

To bring this down from theory to practice, let’s look at some common experiences from SaaS founders, revenue leaders, and buyers who’ve wrestled with the old gold standard.

Experience #1: The Startup That Over-Sold Seats

A mid-stage collaboration SaaS company leaned heavily on annual per-seat deals. Sales reps were incentivized almost entirely on upfront ACV, and the easiest way to hit quota was to push customers into large seat counts for the full year. One enterprise customer was convinced to buy 500 seats for a 300-person team “in anticipation of growth.”

Twelve months later, the usage data told an awkward story: only about 180 of those seats had ever been active. The renewal conversation turned hostile. The customer demanded a massive reduction in seats and a deep discount “to make up for last year’s waste.” The vendor kept the logo but lost 40% of the ARR on renewal.

Lesson learned: the company reworked its comp plans to reward expansion over time rather than just big initial seat counts. They also introduced a smaller “starter” tier and quarterly seat reviews. The result? Slightly smaller first-year deals, but higher net retention and far less renewal drama.

Experience #2: The Buyer Who Refused to Be Locked In

On the other side, a VP of Operations at a high-growth fintech had been burned by multiple annual per-seat contracts that locked in hundreds of unused licenses. When a new vendor pitched yet another 12-month, all-upfront seat deal, she pushed back hard.

Instead, she negotiated a hybrid structure:

- A modest base platform fee that guaranteed support and roadmap input.

- A committed minimum spend that could be used for seats or usage.

- Quarterly checkpoints to adjust the mix based on how different teams were actually using the tool.

The vendor initially balked but ultimately agreed after realizing that this structure could actually lead to more upside as the customer scaled. Two years later, the account was one of their largestwithout ugly surprise conversations at renewal time.

Experience #3: The Product-Led Company That Outgrew Seat-Only Pricing

A product-led SaaS company selling a developer tool started life with a simple, friendly pricing page: Free, Pro, and Team plans, all per-seat. It worked fine when most customers were small dev teams. But as adoption spread across larger organizations, usage patterns stopped matching seat counts. Some teams had dozens of active users pushing enormous volumes of data; others had the same number of seats but a fraction of the activity.

Support costs and infrastructure bills spiked, but per-seat revenue stayed flat. After a painful quarter, the company ran a comprehensive pricing analysis and discovered that the best predictor of customer value and cost was not seatsit was events processed.

They moved to a hybrid model: a smaller per-seat fee plus volume-based pricing tied to events. Existing customers were given a generous grandfathering path and clear migration options. The transition was messy for a few months, but ultimately led to healthier margins and a much stronger alignment between price and value.

Experience #4: When Annual Per-Seat Is Still the Right Tool

Not every story ends with abandoning per-seat. A vertical SaaS platform serving a niche industry (think specialty healthcare practices, property management, or legal services) found that their customers actually preferred straightforward annual per-seat pricing. The typical buyer wanted to know: “What will this cost per person per year?” and valued simplicity over hyper-optimized value metrics.

Rather than forcing a trendy usage-based model, the company kept annual per-seat contracts but modernized the structure:

- Clear tiers by role (admin, power user, occasional user) with different price points.

- An option to add flexible “floating” seats for infrequent users.

- A quarterly usage review and a promise not to surprise customers with hidden fees.

For them, the gold standard wasn’t the model itself, but how transparently and fairly it was implemented.

The Real Gold Standard: Alignment, Flexibility, and Trust

The annual per-seat SaaS contract had a great run. It helped an entire generation of SaaS companies grow, taught the market how to think about recurring revenue, and made ARR the language of the industry. But markets evolve, and the real “gold standard” today isn’t a single pricing modelit’s how well your pricing and contracts align with customer value, support flexibility, and build long-term trust.

If you’re a SaaS founder or revenue leader, the question isn’t “Should we kill per-seat?” It’s:

- Where does per-seat genuinely reflect how customers get valueand where does it not?

- How can we share risk more fairly with buyers?

- What combination of seats, usage, and contract flexibility will help customers grow and help us build a durable business?

Treat the annual per-seat contract not as sacred scripture, but as a toolsometimes useful, sometimes clumsy, and often best when paired with a more modern, value-aligned approach. That mindset, more than any specific pricing grid, is what will separate tomorrow’s SaaS winners from the vendors still clinging to yesterday’s gold standard.