Table of Contents >> Show >> Hide

- Why the Middle Class Feels “Too Rich for the FAFSA”

- Reality Check: FAFSA Doesn’t Have an Income Cutoff

- So What Counts as “Middle Class” Anyway?

- The 86 Things That Define the Middle Class

- What to Do When College Costs Feel Impossible

- Middle-Class Experiences: The FAFSA Squeeze in Real Life (Extended)

- Conclusion

If you’ve ever looked at a college bill and thought, “We make too much for help, but not enough for this”,

congratulations: you’ve met the modern middle class. You probably pay your bills (most months), keep the lights on, and still feel like one

surprise expense could turn your budget into abstract art.

This article breaks down why college affordability hits middle-income families so hard and then delivers the main event:

86 painfully specific, oddly comforting things that define middle-class life in America—from “thermostat negotiations”

to “FAFSA questions that feel like a pop quiz on your own finances.”

Why the Middle Class Feels “Too Rich for the FAFSA”

The phrase is more emotional truth than technical policy. Middle-class families often land in a frustrating gap:

they earn enough that need-based grants may shrink, but not enough to pay thousands (or tens of thousands) per year without

reshaping their entire life.

The middle-class squeeze is real (and it’s not just tuition)

-

Sticker shock is only the beginning: The full cost of attendance includes housing, food, transportation, books, fees,

and sometimes health insurance. -

College costs rise alongside everything else: Housing, healthcare, childcare, and car expenses can chew up the same income that

financial aid formulas assume you can redirect to tuition. - Cash flow matters: Even families with decent incomes may not have liquid savings to cover big, upfront semester bills.

-

More than one kid = more than one “gulp”: Having two college students at once can turn “manageable” into

“mathematically rude.”

Reality Check: FAFSA Doesn’t Have an Income Cutoff

Here’s the part that surprises a lot of families: there isn’t a single “too much income” line that blocks you from filing.

FAFSA is the gateway for federal student aid and is commonly used for state and school aid too. What changes is how much aid you qualify for,

based on your Student Aid Index (SAI) and your school’s cost of attendance.

Even if your SAI is high, filing can still matter because some federal loans (like Direct Unsubsidized Loans) don’t require

demonstrating financial need, and many programs still require the FAFSA as the official paperwork step.

So What Counts as “Middle Class” Anyway?

There isn’t one definition that fits every family in every ZIP code. A common approach used by major researchers defines middle-income households

as those earning roughly two-thirds to double the national median income, adjusted for household size and (sometimes) cost of living.

Translation: middle class can look very different in rural Ohio vs. coastal California, even with the same paycheck.

The 86 Things That Define the Middle Class

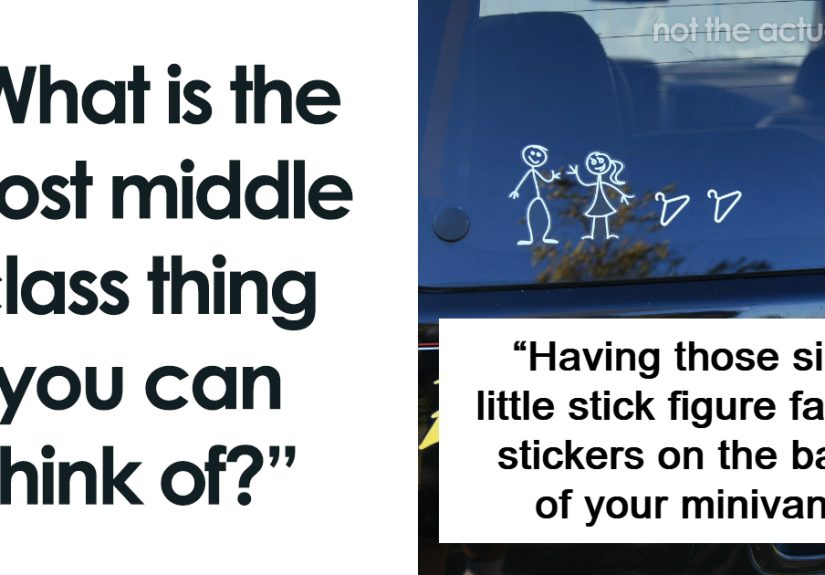

Consider this a loving field guide. Not every item will apply to everyone, but if you recognize a suspicious number of these, welcome to the club.

We don’t have jackets, but we do have coupons.

Money & Bills (1–18)

- You can recite your monthly bills like a playlist: rent/mortgage, utilities, insurance, phone, internet, and that one subscription you swear you canceled.

- You own a “grocery math” system—calculator, notes app, or quiet panic in Aisle 7.

- You have an emergency fund… and a matching emergency guilt fund that whispers, “Is this really an emergency?”

- Your raise gets instantly eaten by insurance premiums, taxes, or both—like your paycheck is being hunted for sport.

- You compare unit prices and feel genuine victory when you save 17 cents per ounce.

- You have a favorite store brand, and you defend it like it’s a family member.

- You know the difference between “needs,” “wants,” and “wants after 9 p.m.”

- You’ve considered a second job, then remembered you already have a first job and a second job called “life.”

- You’ve used a 0% APR intro offer as a temporary life raft (and promised yourself you’ll pay it off “soon”).

- You have a “car fund,” “house fund,” and “please don’t break” fund.

- You have a decent credit score and a mild fear of anything that might upset it.

- You’ve read at least one article a year about negotiating your internet bill, and you’ve rehearsed the script in your head.

- You have a warehouse membership you justify with one bulk purchase and the hope it will pay for itself by 2034.

- You’re one surprise medical bill away from redefining “fun” as “staying home.”

- You’ve said “We’ll do it next paycheck” and meant it with your whole heart.

- You’re not broke, but you’re also not ordering guac without checking the price.

- You buy gifts on sale and talk about it like you personally invented savings.

- You can afford a streaming bundle, but not an out-of-pocket semester.

Work & Benefits (19–30)

- Your job offers “benefits,” which you mostly experience as paperwork and waiting rooms.

- You know what a 401(k) match is and still wish it matched harder.

- You have a direct deposit day and a bill-pay day. You respect them both.

- You’ve stayed at a job you don’t love because the health insurance is decent-ish.

- You own at least one “interview outfit” you refuse to get rid of, just in case capitalism calls again.

- You have a professional email signature that feels slightly like cosplay.

- You’ve used PTO for sick kids and then got sick on the weekend (as tradition demands).

- You know your salary, your take-home, and the mysterious difference between them.

- You’ve Googled “Is overtime worth it after taxes?” at least once.

- You’ve attended a meeting that could have been an email, and you still showed up with a polite face.

- You’ve celebrated paying off one loan by immediately encountering another loan-shaped life event.

- You secretly envy people with pensions the way people envy unicorns: with hope and disbelief.

Housing & Home Life (31–44)

- Your home project timeline is “this weekend” for six months.

- You own a toolbox with at least one mystery screwdriver that fits nothing but still feels important.

- You’ve watched a YouTube tutorial and said, “How hard can it be?” (famous last words).

- You have strong opinions about paint colors, and you learned them the hard way.

- You’ve argued with a contractor quote and then tried DIY out of financial necessity and personal pride.

- Your thermostat is negotiated like an international treaty.

- You have a lawn or plants you maintain out of equal parts joy and spite.

- You’ve had a conversation that begins, “Property taxes went up…” and ends in a sigh.

- You know your mortgage rate or rent increase more clearly than your blood type.

- You have an HOA story, even if you don’t have an HOA. (Your friend has one. You absorbed the trauma.)

- You bought furniture “for the long term” and then immediately got a stain that haunts you.

- You’ve considered downsizing and upsizing in the same month because housing math is chaos.

- You’ve saved sturdy boxes “just in case” and now you basically run a small cardboard museum.

- You’ve replaced something expensive because it “wasn’t worth repairing” and then mourned anyway.

Kids, School, and College Prep (45–56)

- You know school spirit wear is somehow both optional and mandatory at the same time.

- You’ve done the math on daycare/after-school care and briefly lost consciousness.

- You have a group text labeled something like “Soccer Parents (Send Help).”

- You’ve packed lunch to save money and then bought lunch because you forgot the lunch you packed.

- You’ve said “college is important” while staring at tuition like it’s a jump scare.

- You’ve attended a FAFSA night or watched a tutorial and felt personally attacked by the questions.

- You’ve learned the phrase “cost of attendance” and now you dislike it on principle.

- You have a 529 plan… or a plan to start a 529 plan… or a plan to stop thinking about it until tomorrow.

- You’ve looked at community college, AP/dual enrollment, or credit-by-exam options like they’re cheat codes.

- You bought a laptop “for school” that is also suspiciously good for streaming.

- You celebrated a scholarship like you won the lottery (because in this economy, you kind of did).

- You looked at a meal plan price and thought, “Does it come with a private chef and emotional support?”

Health, Insurance, and Adulting Symptoms (57–64)

- You choose between urgent care and the ER like it’s a menu with prices you can’t see.

- You’ve paid a deductible and still felt like you paid twice.

- You know your insurance plan by nickname, like “The High Deductible One.”

- You’ve delayed a doctor visit because “it might go away,” and sometimes it did (which only reinforced the habit).

- You have a dentist you see twice a year and a therapist you keep meaning to schedule.

- You compare generic vs. brand meds at the pharmacy counter like you’re doing competitive finance.

- You own a water bottle that says you’re healthy, even if your schedule disagrees.

- You have a gym membership that competes with your couch for custody.

Transportation (65–72)

- Your car is “paid off” but behaves like it resents that fact.

- You hear a weird noise and instantly think, “How many zeros is this?”

- You know the cheapest gas station along your regular route and feel loyal to it.

- You’ve driven a car until the wheels almost came off (respectfully).

- You debated new vs. used and ended up with “used but reliable-ish.”

- You schedule oil changes the way adults schedule dentist visits: late but proud.

- You have a road trip snack strategy that’s mostly “avoid overpriced rest stops.”

- You use rideshares/public transit selectively—because convenience always has a surcharge.

Food, Fun, and the Art of “Affordable Treats” (73–80)

- You cook at home most nights and still feel like groceries are a luxury.

- Restaurant nights are planned, budgeted, and emotionally significant events.

- You have one “nice” vacation photo you reuse for years, like it’s a family heirloom.

- You’ve mastered the staycation: same town, different towels, zero airfare trauma.

- You buy coffee out sometimes, but you know exactly how often you “shouldn’t.”

- Your entertainment budget includes streaming, not bottle service.

- You have a loyalty app for at least one fast-casual place, and it knows too much about you.

- You said “we’re not buying souvenirs” and then bought one souvenir (for the memories and also the guilt).

Tech & Subscriptions (81–86)

- You rotate streaming services like crops to keep costs down.

- Your phone is not the newest model, but it’s “still great” (and you mean it).

- You have a family plan for something: phones, music, or shared chaos.

- You canceled a subscription and felt powerful for exactly three minutes.

- You back up photos because your phone storage is basically a second rent payment.

- You pay for cloud storage while telling yourself you’re “minimalist.”

What to Do When College Costs Feel Impossible

The middle-class college strategy is rarely one magic trick. It’s usually a stack of small wins that add up—plus a willingness to ask questions

(sometimes repeatedly) until the numbers make sense.

1) File the FAFSA anyway (yes, even if you think you won’t qualify)

Filing can unlock federal loans and may be required for state programs and many schools’ need-based or institutional processes. Even when grants are limited,

paperwork is often the toll you pay to enter the aid conversation.

2) Focus on net price, not sticker price

Two colleges can post wildly different tuition numbers and end up costing the same (or the “expensive” one can be cheaper) once grants and discounts

are applied. The goal is not to win an argument with the sticker price—it’s to find a realistic net cost for your family.

3) Consider cost-smart pathways that still lead to strong outcomes

- In-state public options often have lower published tuition than out-of-state choices.

- Community college + transfer can reduce the total years at the higher-cost institution.

- Dual enrollment/AP/credit-by-exam can shave credits (and dollars) off the total.

- Living at home can dramatically cut room-and-board costs for the right student and family.

4) Treat the financial aid office like a partner (politely persistent wins)

If your circumstances changed (job loss, medical bills, divorce, disaster, childcare costs, elder care), ask about a professional judgment review or appeal.

Many families don’t ask because it feels awkward. Awkward is temporary; tuition is expensive.

Middle-Class Experiences: The FAFSA Squeeze in Real Life (Extended)

Picture a family that looks “fine” on paper: two working parents, a mortgage, a couple of cars, and a household income that sounds solid at a barbecue.

Now picture them sitting at the kitchen table in October with the FAFSA open, three browser tabs titled “SAI,” “cost of attendance,” and

“why is everything $400 now.”

This is the heart of the “too rich, too poor” feeling. The family isn’t trying to game the system; they’re trying to understand it.

They know the FAFSA isn’t judging their character, but it can feel like it’s judging their life choices. Yes, you have retirement savings.

Yes, you have a house. No, you can’t sell the house to pay for Biology 101 without becoming homeless, which is a bold approach to higher education.

Many middle-income families describe the same emotional whiplash: they’re proud they’ve built stability, but the system reads stability as “capacity.”

That might be fair in theory—until you add real-world costs that don’t politely wait their turn. Childcare can rival a second mortgage in some areas,

health insurance premiums and deductibles can spike unexpectedly, and housing costs can climb faster than paychecks. So the family is left with a weird kind of

financial invisibility: not struggling enough for major grants, not wealthy enough to write checks without pain.

Then there’s the college search itself, which for middle-class families often becomes a second job. They compare tuition and fees, but also housing costs,

transportation, book estimates, meal plans, and whether a school requires students to carry health insurance. They learn that an “affordable” college

can get expensive if the student must live on campus, and that an “expensive” college might offer enough institutional aid to compete—especially

if the student has strong grades or a compelling application.

The FAFSA experience also tends to expose the difference between income and cash flow. A family might earn enough to land in

the middle-income band, but if that income is already assigned to housing, insurance, groceries, car repairs, and helping Grandma with prescriptions, it doesn’t

magically transform into “college money” because a formula says it could. That’s why you hear middle-class parents say things like,

“We’re doing okay, but we’re not okay-‘enough’ for this.”

And yet, middle-class families are also incredibly resourceful. They stack scholarships, chase in-state tuition, and consider community college transfers without

treating them like a downgrade. They ask about work-study, live at home for a year or two, and take advantage of dual enrollment if the high school offers it.

They negotiate the choice of major with real job outcomes in mind (sometimes gently, sometimes with spreadsheets). They talk about budgeting in a way that quietly

teaches kids: money is a tool, not a moral score.

The most common “middle-class win” isn’t finding a secret pile of free money. It’s building a plan that is honest about tradeoffs:

picking a school that won’t bury the student in debt, choosing a path that keeps options open, and refusing to confuse prestige with value. In that sense,

the “too rich for the FAFSA” crowd is doing something important: insisting that college affordability isn’t only a low-income issue or a luxury

problem. It’s a middle-class reality—and it deserves middle-class solutions.

Conclusion

The middle class isn’t one paycheck number—it’s a daily balancing act. It’s planning, saving, hoping nothing breaks, and then fixing what

breaks anyway. And when it comes to college, it’s often the loudest example of the same story: families who do “everything right” can still feel

priced out.

If you take one thing from this: file the FAFSA, compare net prices, and build a path that protects your future self. Middle-class families

don’t need perfect answers. They need realistic ones.